Should An Llc Get A 1099

If established as a single-member LLC they file their taxes as an individual so you will provide them with the Form 1099. You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate.

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

C Corporation Vs S Corporation Vs Llc Bookkeeping Business C Corporation S Corporation

According to the IRS you must file a 1099 MISC for each person whom you have paid during the year at least 600 in rents services including parts and materials prizes and awards other income payments health care payments crop insurance proceeds cash payments for fish or generally the cash paid from a notional principal.

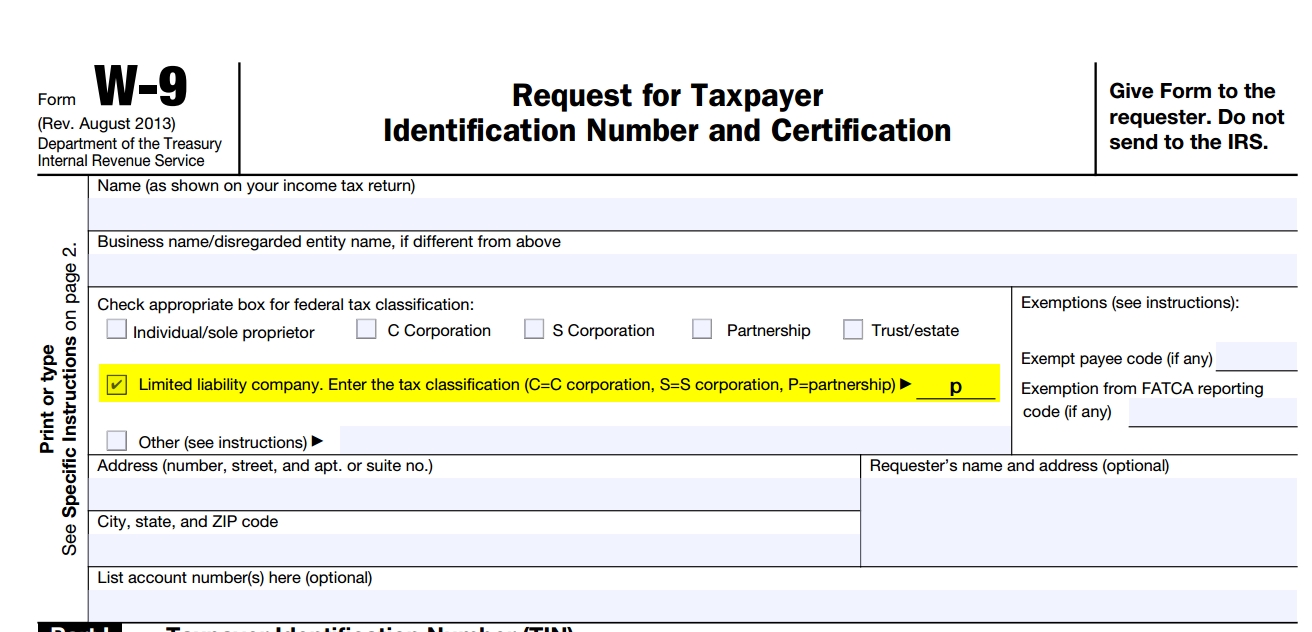

Should an llc get a 1099. Our 2 member LLC includes myself as a real estate broker and my partner as a real astate agent as 5050 partners. A W-9 form is necessary because it allows. Should an Independent Contractor form an LLC.

And a great way to prove youre contracting work is a business is by forming an LLC. You contract with a business that is an LLC sole proprietorship. At worst if a partnership the K-1 will indicate change in equity or guaranteed payments.

A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832. The LLC owners are called membersEach member is paid from the business as an owner not as an employee. Owners pay do you 1099 it.

They dont have to report payments that were made for personal reasons. In addition to that your taxes wont become much more complicated and youll enjoy the limited liability of any other LLC or corporation. When commissions come in we first pay commission to the external cooperating brokerage firm then split the rest according to our brokeragent agreement not a 5050 split.

However if an it is taxed as a partnership the IRS requires it to issue Form 1099-MISC. You will need to send out a 1099-NEC form if youre working with an LLC sole proprietorship. Form 1099 is a type of information return the IRS requires payers to issue as proof that they incurred.

It makes no difference for tax purposes. Business owners only have to report payments for services or rent that were earned for business purposes. However see Reportable payments to corporations later.

In real estate brokers and agents usually receive 1099 forms. Generally independent contractors also known as 1099 workers are considered self-employed and a sole-proprietorship. Do I Need a 1099 for an LLC.

As a general rule a business is not required to issue a 1099 to a. Payments for which a Form 1099-MISC is not required include all of the following. An LLC that is taxed as a corporation files different forms that replace the use of Form 1099-MISC.

Otherwise they or their clients could get into trouble. Email to a Friend. There are two types of LLCs - a single owner LLC called a single-member LLC and a multiple-owner multiple-member LLC.

Form 1099-MISC although they may be taxable to the recipient. 1099 contractors need to treat their service as a business. It depends on how the LLC is taxed.

Payments Requiring Issuance of a 1099. When your total rent payments require a 1099-MISC you will first need to request a W-9 form from the LLC that leases the property to you. A Limited Liability Company LLC is an entity created by state statute.

The IRS uses Form 1099-MISC to keep track of how much money or other benefits the LLC has paid an independent contractor subcontractor or other nonemployee. The limited liability company LLC is a peculiar form of business type and a recent addition to the types of businesses. If a business buys or rents products or services that amount to more than 600 from one person or LLC during the year it has to file a 1099 for that contractor or vendor.

If you are 1099 you will pay the same amount of taxes as if you formed a corporation and then paid yourself essentially you are doing this as a 1099 contractor just not formally. Other Types of Business Structures. Form 1099 generally needs to.

In general any time your business buys products rent or services that total more than 600 from a single individual or limited liability company LLC during a calendar year you need to file a 1099 form for that vendor or contractor. If owner is a sole proprietor or an LLC then there is no such thing as pay only equity draw. You can read about other exceptions such as cash payments for fish yes its a thing here.

However if your independent contractor has their business established as a corporation either an S Corp or a C Corp then for tax purposes they would be considered as such and would not typically be filing Form 1099s. As such you will be required to pay self-employment taxes. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation.

Legally I dont know the answer. Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity.

Get To Know How To Set Up An Llc Start Your Successful Business In The Us Http Blog Invoiceber Small Business Organization Llc Business Business Checklist

Get To Know How To Set Up An Llc Start Your Successful Business In The Us Http Blog Invoiceber Small Business Organization Llc Business Business Checklist

Ask The Taxgirl Form 1099 Misc Mistake Tax Forms Doctors Note Template Important Life Lessons

Ask The Taxgirl Form 1099 Misc Mistake Tax Forms Doctors Note Template Important Life Lessons

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

How To File Your 1099 The Creative Law Shop Entrepreneur Advice Creative Business Owner Creative Entrepreneurs

How To File Your 1099 The Creative Law Shop Entrepreneur Advice Creative Business Owner Creative Entrepreneurs

Businesses Must Need An Agreement With The 1099 Employees 1099 Employee Works On A Contract Basis The Payer Internal Revenue Service Employee Jokes For Kids

Businesses Must Need An Agreement With The 1099 Employees 1099 Employee Works On A Contract Basis The Payer Internal Revenue Service Employee Jokes For Kids

Llc Vs S Corp A Step By Step Guide For Choosing The Best Small Business Entity Careful Cents Budgeting Finances Business Budgeting

Llc Vs S Corp A Step By Step Guide For Choosing The Best Small Business Entity Careful Cents Budgeting Finances Business Budgeting

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

How To Create Your Blog Privacy Statement Jade Oak Sole Proprietor Blog Blog Tips

How To Create Your Blog Privacy Statement Jade Oak Sole Proprietor Blog Blog Tips

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

201 Tax Difference Between Llc And S Corp Llc Vs S Corporation Explanation Freelance Tax 1099 Tax Yo Llc Taxes Financial Literacy Budgeting Finances

201 Tax Difference Between Llc And S Corp Llc Vs S Corporation Explanation Freelance Tax 1099 Tax Yo Llc Taxes Financial Literacy Budgeting Finances

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

1099 Misc Forms Q A For Commission Paid In 2016 Berkshirerealtors

How Do You Record A Paycheck To Yourself If You Re An Llc Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Llc Business Small Business Finance

How Do You Record A Paycheck To Yourself If You Re An Llc Amy Northard Cpa The Accountant For Creatives Small Business Bookkeeping Llc Business Small Business Finance

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Correctly Set Up W 9 And 1099 Forms In Quickbooks To Avoid Irs Notices

Here You Find Full Detail About Quickbooks 1099 Forms Quickbooks Quickbooks Online Bookkeeping Software

Here You Find Full Detail About Quickbooks 1099 Forms Quickbooks Quickbooks Online Bookkeeping Software

What Happens If A Payer Doesn T Send 1099 Misc Irs Irs Forms 1099 Tax Form

What Happens If A Payer Doesn T Send 1099 Misc Irs Irs Forms 1099 Tax Form

Replace An Ssa 1099 1042s Social Security Benefits Social Security Social Security Disability

Replace An Ssa 1099 1042s Social Security Benefits Social Security Social Security Disability

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose