Hmrc Private Mileage Claim Form

How to claim mileage from HMRC. Alternatively if you do not file a self-assessment tax return use form P87.

What You Need To Know About Owner Operator Vs Company Driver Taxes Right Now Trucking Business Tax Company

What You Need To Know About Owner Operator Vs Company Driver Taxes Right Now Trucking Business Tax Company

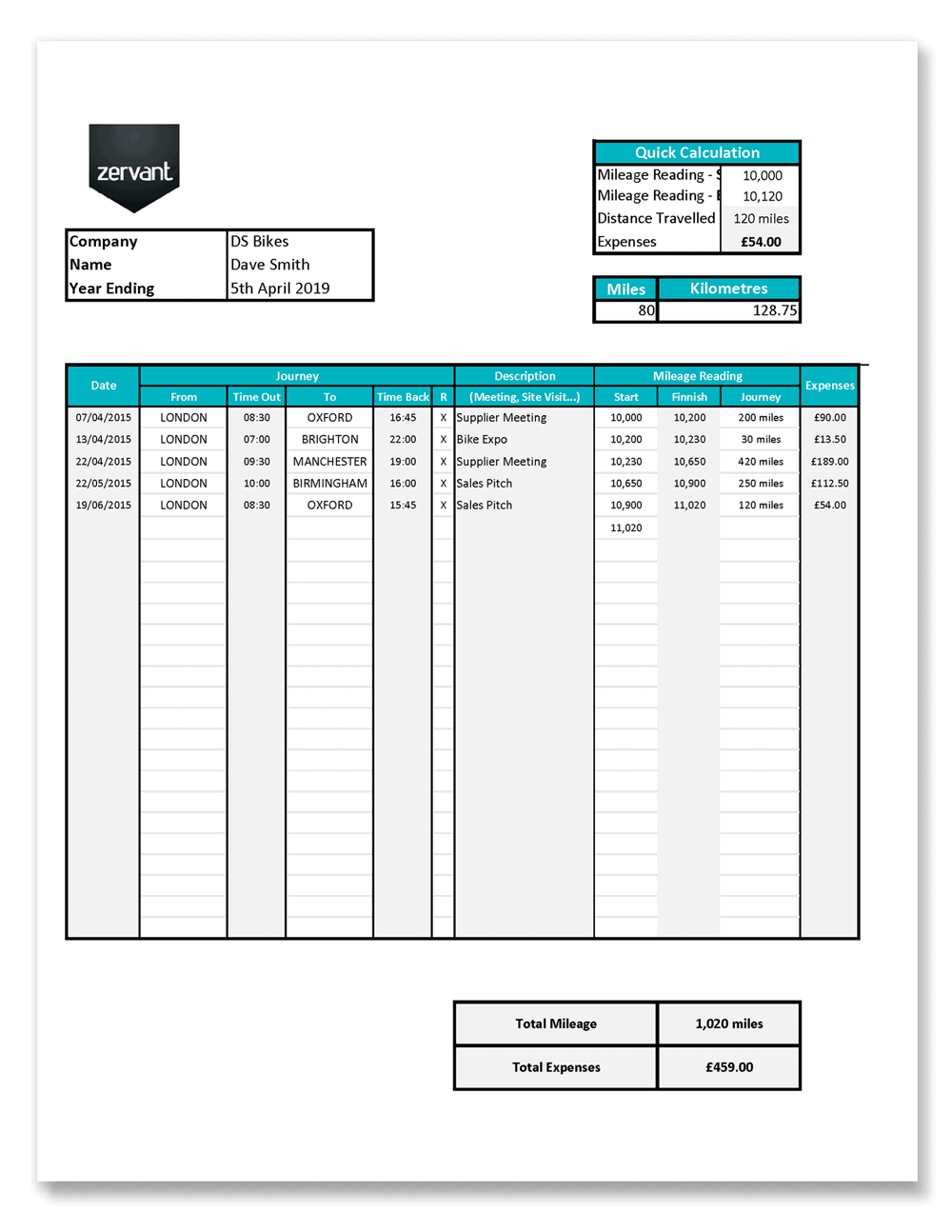

Download our free mileage claim template form as an Excel spreadsheet to help you record the details of each work trip.

Hmrc private mileage claim form. A survey by YouGov found that 56 per cent of company car drivers are unaware of HMRC rules on reclaiming business mileage. Claiming your business miles is a form of tax relief meaning the cost of your mileage will reduce your tax bill at the end of the year. So according to the latest AMAP rates you can claim 3600 8000 x 45p.

Talk to your employer and ask them to report the shortfall to HMRC under the Mileage Allowance Relief Optional Reporting Scheme. If you dont file a self-assessment tax return use a P87 form. Check out my favourite picks-.

Weve written up a guide to show you how to claim mileage through HMRC - skip ahead to Mileage Allowance Relief here. Mileage allowance payments not taxed at source P11D WS6 Use form P11D WS6 if youre an employer and need to work out the cash equivalent of. Some people buy these cars as an eco-friendly alternative to the large petrol engines and soon to be phased out diesel engines.

Simply sign up to Crunch Chorus our free self-employed community and you can download our easy to use mileage spreadsheet for the current and previous tax years that will record and calculate your business mileage in a professional format making it easy to claim. If youre an employee claiming less than 2500 business mileage use Form P87. Very simply HMRC mileage allowance lets you claim a reduction of your taxable income to partially offset what youve spent on certain travel costs for business trips and not had reimbursed by an employer.

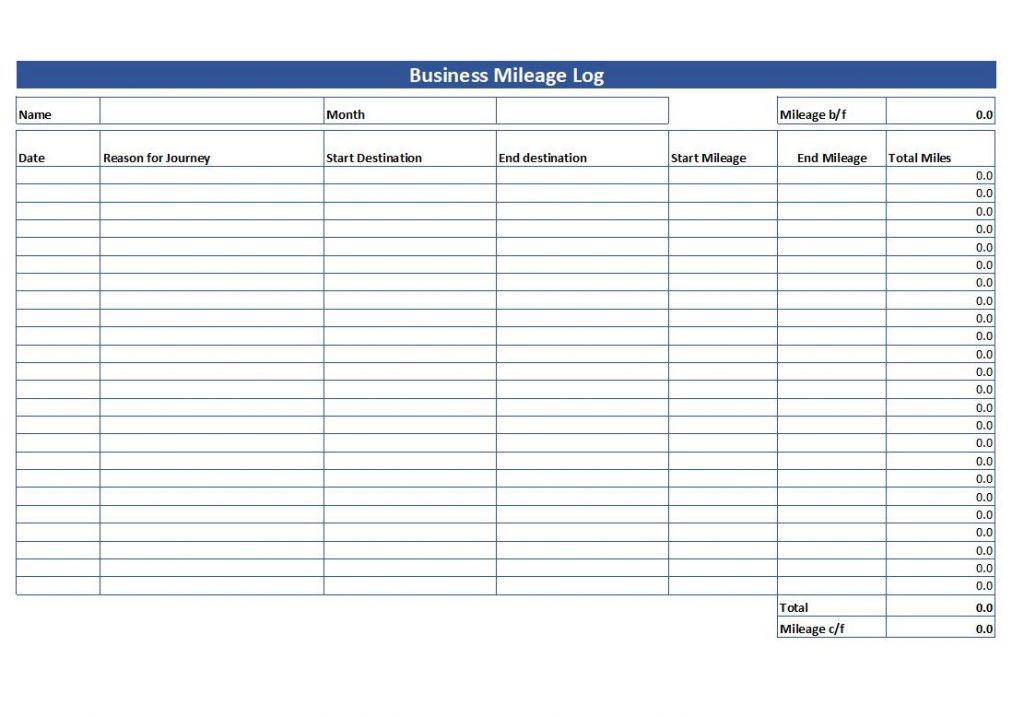

The easiest way to record your journeys and work out how much you can claim is on a business mileage claim form spreadsheet ours is free and easy to use. Relevant motoring expenditure - payments for private use of a vehicle NIM05825. How to keep track of drives for your mileage log.

Here are our recommendations on how to accurately record mileage to help prevent you being fined. If you usually do not need to complete a tax return you can use form P87 on HMRCs website to claim MAR. For example if you pay the 20 basic rate of tax and claim tax relief on 6 a week you would get 120 per week in tax relief 20 of 6.

If your claim is over 2500 you must. Youve made 8000 business-related miles in your private car in 2018. If youve received partial reimbursementfor instance you receive 25p per mile rather than HMRCs approved mileage rate of 45p per mileyou can claim tax relief on the difference.

Motoring expenses including mileage allowances paid after 6402. Add up your business mileage for the whole year. If you use your own vehicle or vehicles for work you may be able to claim tax relief on the approved mileage rate.

Failing that make a claim yourself using a P87 form or via your own self-assessment tax return. In the UK you can claim back up to 45p per mile for the first 10000 miles and then 25p per mile. The sale of electric and hybrid cars have seen a massive boom over the last couple of years.

It may seem straight-forward enough but the lines between business and private journeys can often become blurred. Accepted forms include a paper mileage logbook a spreadsheet on a computer or using a mileage tracking app like MileIQ. On your self-assessment tax return.

This covers the cost of owning and running your vehicle. Youll need the following information to hand. You can complete your P87 form online or by completing a postal form.

Check if you can claim Previous. If your employer pays you less than the approved mileage allowance you are entitled to Mileage Allowance Relief MAR in the form of tax deductions on the outstanding MAP. Business miles for self-employed can also be claimed.

The HMRC permits you to use whichever reliable method you prefer to maintain your mileage log. Alternatively youll need to complete a self-assessment tax. Deduct your employers mileage limit if applicable.

If your employer reimburses you for your business mileage you can only claim the difference between what your employer paid you and the AMAP rate. Add up the Mileage Allowance Payments you have received throughout the year. Subtract the received MAP from the approved amount you should have received.

When using a vehicle for your business its important to keep accurate records of every work journey including the dates and mileage. If your claim exceeds 2500 you must file a self-assessment tax return. HMRC lets you claim mileage tax relief both if youre employed or self-employed.

You cannot claim. HMRC require you to keep records of all transactions which includes claims for car use. It applies only to distance covered during the relevant tax year and only to travel using vehicles not owned by your employer so no company cars.

Why keep a mileage tracking sheet. For amounts less than 2500 file your claim. Their increasing popularity saw HMRC introduce mileage reimbursement rates for hybrid and electric vehicles in 2018.

For many years a paper mileage log was the only method of maintaining this record. Multiply your business mileage by HMRCs Approved Mileage Allowance Payment rate or AMAP. Your National Insurance number.

Free Uk Mileage Log Excel Zervant Blog

Free Uk Mileage Log Excel Zervant Blog

Looking For Miles Tracker Visit Https Milecatcher Com Their Mile Tracking App Shows The Most Accurate Mileage Repo Mileage Tracker Tracking App Mileage App

Looking For Miles Tracker Visit Https Milecatcher Com Their Mile Tracking App Shows The Most Accurate Mileage Repo Mileage Tracker Tracking App Mileage App

Simple Mileage Log Free Mileage Log Template Download

Simple Mileage Log Free Mileage Log Template Download

Expense Reimbursement Form Template Fresh Mileage Reimbursement Form 9 Free Sample Example Mileage Invoice Template Excel Templates

Expense Reimbursement Form Template Fresh Mileage Reimbursement Form 9 Free Sample Example Mileage Invoice Template Excel Templates

The Irs Mileage Deduction Lets You Write Off Miles For Taxes See The Standard Mileage Rates For 2017 2016 Amp Previous Mileage Deduction Mileage Guide Book

The Irs Mileage Deduction Lets You Write Off Miles For Taxes See The Standard Mileage Rates For 2017 2016 Amp Previous Mileage Deduction Mileage Guide Book

Mileage Expense Form Template Free Luxury 8 Mileage Log Templates To Keep Your Mileage On Track Timetable Template Marketing Cover Letter Templates

Mileage Expense Form Template Free Luxury 8 Mileage Log Templates To Keep Your Mileage On Track Timetable Template Marketing Cover Letter Templates

Travel Expense Reimbursement Form Template Awesome 13 Free Mileage Reimbursement Form Template In 2020 Mileage Reimbursement Templates Business Travel

Travel Expense Reimbursement Form Template Awesome 13 Free Mileage Reimbursement Form Template In 2020 Mileage Reimbursement Templates Business Travel

![]() Vehicle Mileage Tracker Template Vincegray2014

Vehicle Mileage Tracker Template Vincegray2014

Free Mileage Log Template For Taxes Track Business Miles Mileiq Uk

Free Mileage Log Template For Taxes Track Business Miles Mileiq Uk

Hmrc Form P87 What You Need To Know For Taxes

Hmrc Form P87 What You Need To Know For Taxes

Free Mileage Log Template Download Ionos

Medical Mileage Deduction 101 Medical Mileage Deductions Are Most Often Related To Your Trips To The Doctor Med Mileage Deduction Air Quality Sensor Deduction

Medical Mileage Deduction 101 Medical Mileage Deductions Are Most Often Related To Your Trips To The Doctor Med Mileage Deduction Air Quality Sensor Deduction

Mileage Expense Form Template Free Unique Mileage Log Template 14 Download Free Documents In Pdf Doc Attendance Sheet Template Templates Free Design Templates

Mileage Expense Form Template Free Unique Mileage Log Template 14 Download Free Documents In Pdf Doc Attendance Sheet Template Templates Free Design Templates

Self Employed Accounting Software Quickbooks Uk Track Your Self Employed Income Using Flat Rates For Hmrc Self Assessment Tax R Tax Software Quickbooks Self

Self Employed Accounting Software Quickbooks Uk Track Your Self Employed Income Using Flat Rates For Hmrc Self Assessment Tax R Tax Software Quickbooks Self

Milecatcher Is A Free Mileage Tracker That Automatically Logs The Miles You Drive For Business It Tracks How Long Y Mileage Tracker Mileage Tracker App Mileage

Milecatcher Is A Free Mileage Tracker That Automatically Logs The Miles You Drive For Business It Tracks How Long Y Mileage Tracker Mileage Tracker App Mileage

A Simple Excel Mileage Claim Tool From Working Data

A Simple Excel Mileage Claim Tool From Working Data

Spreadsheet Free Gas Mileage Log Template Great Sheet Uk For With Regard To Gas Mileage Expense Report Template Mileage Free Gas Templates

Spreadsheet Free Gas Mileage Log Template Great Sheet Uk For With Regard To Gas Mileage Expense Report Template Mileage Free Gas Templates

A Simple Excel Mileage Claim Tool From Working Data

A Simple Excel Mileage Claim Tool From Working Data

Vehicle Mileage Tracker Template Vincegray2014

Vehicle Mileage Tracker Template Vincegray2014