Can I Buy A House With A 1099

The IRS can also leverage Big Data and advanced tracking methods to use your lifestyle against you. To understand how glance at the hypothetical scenario below.

Rear Elevation Of The Touchstone House Plan Number 1099 D But Wait This Looks Almost Exactly Like The House My Da House Plans Best Home Plans House Design

Rear Elevation Of The Touchstone House Plan Number 1099 D But Wait This Looks Almost Exactly Like The House My Da House Plans Best Home Plans House Design

There are a few nuances to note there so weve broken them up in two sections to outline what the 1099.

Can i buy a house with a 1099. The first four 1099 form types all have to do with investing while the bottom two forms cover income derived from rents royalties and nonemployee work. Can I Buy a House if Im a 1099 Contractor. What is a 1099 form used for.

All of the distribution will still be subject to income tax and any amount over the 10000 will still be subject to an early distribution penalty. Just about any lender can do self-employed mortgages. Where can I get a 1099 form.

But its a bit more complicated than just a simple yes. The short answer is yes. You can complete these copies online for furnishing statements to recipients and for retaining in your own files.

Homeowners are eligible for tax breaks for buying or owning a house but many of the rules changed in the past few years. Only a distribution from an IRA account qualifies and then up to 10000 of the distribution will be exempt from any early distribution penalty. June 6 2019 312 AM.

Griffin is self-employed himself and has worked with many self-employed buyers and he says I have seen the highs and lows of 1099ers wanting to purchase a home. The first step to getting mortgages for 1099 employees is prequalification. 1099R Box 7 Code 1 includes 1st time home buyer exception according to the IRS but in TurboTax Code 1 has no exceptions.

When youre looking to prequalify for a mortgage and the majority of your income is as a 1099 independent contractor lenders will evaluate your earnings differently than they do. Yes the IRS DOES get copies of those 1099s and one of these days they will be knocking on Moms door for a whole bunch of taxes plus penalties. 1099-R First home purchase--How does one qaulify for this.

Expected Cost of Living and Subsequent Analysis When You Buy or Sell a House. But there are additional requirements for self-employed borrowers. Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures.

Your financial institution will report your withdrawal to the Internal Revenue Service and send you a. By simply calling the bank or submitting a form online with basic information about your 1099 income debt and assets you can get a quick estimate of how much you could afford to borrow for a home. But you can often claim an exception if you dip into your account to buy or build a first home.

No portion of the residence was used for business or rental purposes by you or your spouse. Ive seen families do this a lot where a parent does their returns as well as their children often when theyre in college. They are Buying a Home with a 1099 which usually sends mortgage companies into a mild panic.

In that way you can share TurboTax with someone else when you buy the software but you are limited to five e-files. Notice a pattern above. Most people are payed with a paycheck stub from their employer who takes out the taxes accordingly and then pays the employee.

I currently make 45000 and my wife is a tenured high school teacher who. When youre considering buying a home the first financial step you often take is to obtain a mortgage prequalification from your lender. Jane Marie just sold a house for 350000 in cash and all of her capital gain was excludable.

You generally need to report the sale of your home on your tax return if you received a Form 1099-S or if you do not meet the requirements for excluding the gain on the sale of your home. When you do you can prepare the returns of you and your immediate family. 2017 - 3 min read How to buy a house.

Without a doubt it. One year tax returns required whereas a mortgage applicant with a 620 credit score 5 down payment 1 credit tradeline and no reserves will most likely not get a one-year 1099 andor tax return approval. Going From 1099 Income Versus W-2 Income As mentioned earlier it is much tougher to qualify for a mortgage for 1099 income versus W-2 income.

This step relies on the information you verbally report or type. You receive 1099 tax forms. Normal employees are not allowed many deductions except their house and a.

Dont worry though because after this youll understand how to get your mortgage.

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

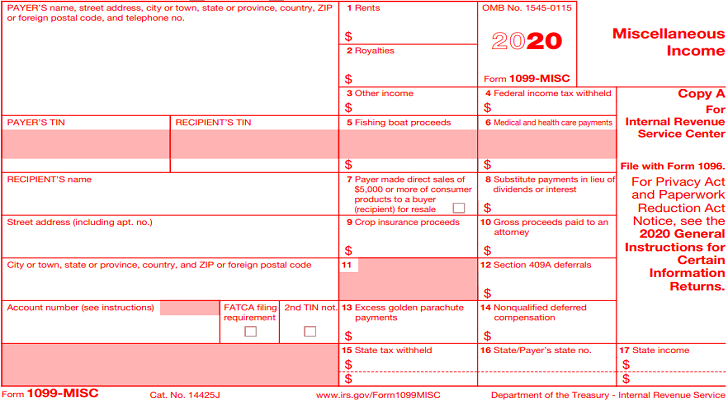

1099 Misc Forms The What When How Buildium Irs Forms 1099 Tax Form Fillable Forms

1099 Misc Forms The What When How Buildium Irs Forms 1099 Tax Form Fillable Forms

Credit Tips And Tricks Learn How To Fix Your Credit Debt Problems Befo Home Mortgage Home Buying Process Home Financing

Credit Tips And Tricks Learn How To Fix Your Credit Debt Problems Befo Home Mortgage Home Buying Process Home Financing

Homenova Slideshow 1099 Walker St Wroxeter Ontario House Styles Outdoor Decor Ontario

Homenova Slideshow 1099 Walker St Wroxeter Ontario House Styles Outdoor Decor Ontario

The Touchstone Plan 1099 D House Plans House Design House

The Touchstone Plan 1099 D House Plans House Design House

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

What Is Irs Form 1099 Misc Smartasset

What Is Irs Form 1099 Misc Smartasset

Idea House At Fontanel Carriage House 1099 Sq Ft Kitchen Living Dining Room Fireplace 1 Bedroom House Plans Southern Living Homes Carriage House Plans

Idea House At Fontanel Carriage House 1099 Sq Ft Kitchen Living Dining Room Fireplace 1 Bedroom House Plans Southern Living Homes Carriage House Plans

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

216 Montclair Ln Salinas Commercial Property Property Montclair

216 Montclair Ln Salinas Commercial Property Property Montclair

Mortgage With 580 Credit Score Home Purchase Refinance Cash Out Credit Score Refinance Mortgage Refinancing Mortgage

Mortgage With 580 Credit Score Home Purchase Refinance Cash Out Credit Score Refinance Mortgage Refinancing Mortgage

Is Real Estate Agent Cash Back Taxable In Us 1099 Misc Usa

Is Real Estate Agent Cash Back Taxable In Us 1099 Misc Usa

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

All About Forms 1099 Misc And 1099 K Bookkeeping Business Business Tax Business Advice

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

What The Heck Is Irs Form 1099 S And Why Does It Matter Value Statement Examples Business Case Template Irs Forms

What The Heck Is Irs Form 1099 S And Why Does It Matter Value Statement Examples Business Case Template Irs Forms

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

What Is Acquisition Or Abandonment Of Secured Property Form 1099 A

What Is Acquisition Or Abandonment Of Secured Property Form 1099 A