Which Form Of Business Organization Has Its Own Legal Personality

In international society international legal relations are generally formed by treaties. Without legal personality one cannot commit an unlawful act.

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

When a company is formed it becomes a legal entity in its own right.

Which form of business organization has its own legal personality. A company is a separate legal person distinct from its shareholders and directors. As a company is incorporates under the Act it will automatically has the perpectual succession its own common seal and the power to hold land. It has rights and liabilities of its own which are distinct from those of its shareholders.

Subject to very limited exceptions most of which are statutory a company is a legal entity distinct from its shareholders. The separate legal personality of a company as aforementioned represents one of the most fundamental principle of company law. It has the legal personality of its own and it can sue and can be sued in its own name.

Companies are incorporated to form an entity with a separate legal personality. It is now considered that an international organization has its own legal personality is subject to international law and has rights and duties under international law. However unlike natural persons a corporation can act only through its agents.

With its own legal identity. It is a legal person. An international organization could not be liable if it was not subject to law.

Its property is its own and not that of its shareholders. The sole proprietorship is considered a legal entity. The corporate personality allow the company to sue and being sued enter into contracts incur debt and own a property.

While there are many reasons businesses choose the C Corporation form of legal entity the primary driver is corporate finance law. The company has its own legal personality. A corporation is distinct from its individual members.

Established by the House of Lords in the Salomon case ii this principle delineates the legal relationship between a company and its members. Corporate personality allow one corporate to act as a single entity for legal purpose. Therefore it is taxed separately from the owner False Double taxation is a distinct advantage that corporations have over other forms of ownership.

Since a Company has a legal personality distinct from that of its members a creditor of such a Company can sue only the Company for his debts and not any of its members. Separate to the individuals involved with the company. A Whereas English law treats apartnership as simply a group of individuals trading collectively theeffect of incorporation is that a company once formed has its owndistinct legal personality completely separate from its members.

A C Corporation is the most common business entity for large companies and those which are publicly traded. Even though a legal person is a legal concept it does have its own legal personality and can acquire rights and incur obligations which are separate from those of the Directors and Shareholders. This means that the organisation.

An entity which has international legal personality can be a subject of international law and then can be a regular member of international society. The Limited Company is the most common legal form in use for running a business. It does not come to end with the death of its individual members and therefore has a perpetual existence.

Perpetual Existence The existence of a Company is not affected by the retirement death lunacy or insolvency of its members. That formation is known as incorporation.

Quiz Forms Of Business Organization Proprofs Quiz

Quiz Forms Of Business Organization Proprofs Quiz

Benefits Of Irs Ein Online Application Apply For Ein Today Online Application Irs How To Apply

Benefits Of Irs Ein Online Application Apply For Ein Today Online Application Irs How To Apply

Legal Persons Lat Persona Iuris Are Of Two Kinds Natural Persons People And Juridical Persons Also Business Networking Global Business Human Resources

Legal Persons Lat Persona Iuris Are Of Two Kinds Natural Persons People And Juridical Persons Also Business Networking Global Business Human Resources

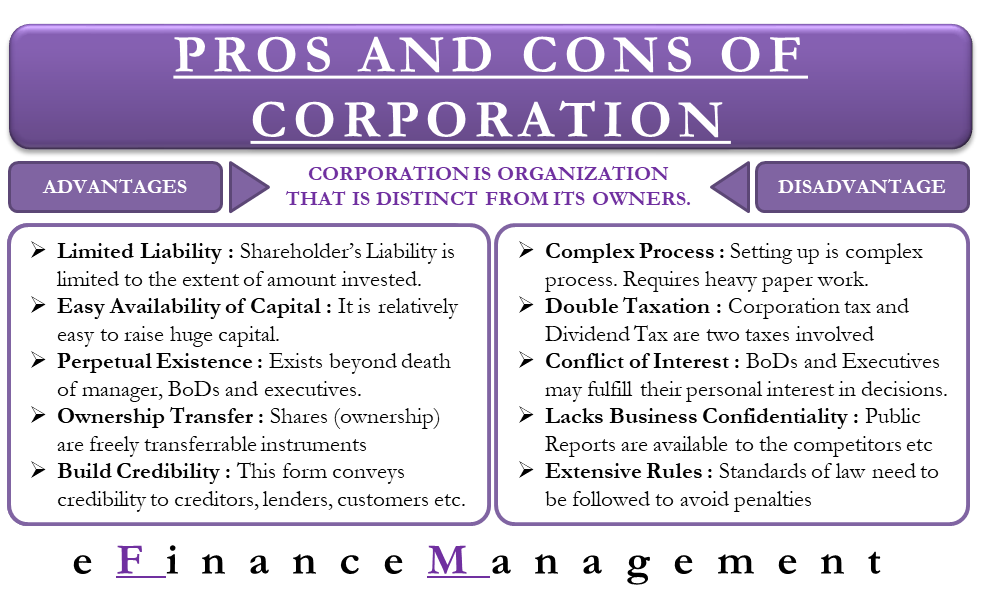

Advantages And Disadvantages Of Corporations Efinancemanagement

Advantages And Disadvantages Of Corporations Efinancemanagement

12 2 Organizational Design Small Business Management

12 2 Organizational Design Small Business Management

International Lawyers Network For Legal Services Legal Services Business Lawyer Service Learning

International Lawyers Network For Legal Services Legal Services Business Lawyer Service Learning

Chapter 6 Forms Of Business Ownership Fundamentals Of Business

Chapter 6 Forms Of Business Ownership Fundamentals Of Business

The 5 Types Of Organizational Structures Lockheed Martin Organizational Structure Organizational Structure Organizational Communications Strategy

The 5 Types Of Organizational Structures Lockheed Martin Organizational Structure Organizational Structure Organizational Communications Strategy

3 Management Levels In Organizational Hierarchy

3 Management Levels In Organizational Hierarchy

Business Analyst Project Management Analysis Course Professional Organizer Business Business Organization Professional Organizer

Business Analyst Project Management Analysis Course Professional Organizer Business Business Organization Professional Organizer

Free Brand Voice Guide What Is Copywriting And Why Does It Matter For My Creative Small Bus Creative Small Business Business Blog Small Business Organization

Free Brand Voice Guide What Is Copywriting And Why Does It Matter For My Creative Small Bus Creative Small Business Business Blog Small Business Organization

Trailblazing In Denmark Podcast Ep 35 Podcasts Social Media Advice Business Organization

Trailblazing In Denmark Podcast Ep 35 Podcasts Social Media Advice Business Organization

Llc Operating Agreement Template Llc Operating Agreement Template Http Webdesign14com Operati Limited Liability Company Separation Agreement Template Agreement

Llc Operating Agreement Template Llc Operating Agreement Template Http Webdesign14com Operati Limited Liability Company Separation Agreement Template Agreement

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

Partnership Agreement Template Free Business Letter Format Contract Template Lettering

Partnership Agreement Template Free Business Letter Format Contract Template Lettering

Sample Requisition Form Example Form Example Form Business Template

Sample Requisition Form Example Form Example Form Business Template

Difference Between Limited Liability Partnership Limited Liability Company Liability

Difference Between Limited Liability Partnership Limited Liability Company Liability