Small Business Rate Relief Application Form Birmingham

You can apply for small business rate relief by filling in our online form. Guidance notes when applying for small business rate relief The criteria for relief are as follows.

National Non Domestic rates hardship relief application form.

Small business rate relief application form birmingham. Rates relief is handled differently in Scotland Wales and Northern Ireland. Please note an application for Small Business Rates Relief cannot be backdated prior to 1st April 2010. You can submit your application by POST to.

If you wish to apply for Small Business Rates Relief please complete the Small Business Rates Relief online form. More than one property in England where the rateable value for each of the other properties is less than 2900 and the total rateable value for all properties is less than 20000. Use this form to apply for Small Business Rate Relief if your business property has a rateable value of 15000 or less.

It is a criminal offence for a ratepayer to give false information when making an application for small business rate relief and checks will be done to verify the. Eligible properties with a rateable value up to 12000 will receive 100 rate relief and have their bills calculated by using the small non-domestic rate multiplier. You can get small business rate relief if you occupy.

Your business rates account number found on the top right corner of your business rates bill. Birmingham City Council Economy Directorate Customer Services Revenues Business Rates PO Box 5 Birmingham B4 7AB. Small business rates relief is reviewed annually.

Service Apply for Small Business Rate Relief Please complete the online form by clicking on the blue start button. If youre applying on behalf of someone else youll need to get this information from them. Apply for Business Rates relief You must keep paying the rates shown.

The small business multiplier is 491p and the standard multiplier is 504p from 1 April 2019 to 31 March 2020. Notifying us about changes Once small business rates relief is granted there is no need for you to reapply. Small business rate relief.

There is no need to apply for small business rates relief if your rateable value is between 15000 and 50999 as the small business rate multiplier will be granted to you automatically even if you have multiple properties. One property only with a rateable value of less than 15000or. Please read the attached notes before completing this application form.

Small business rate relief guidance notes. You have to contact your local council to see if youre eligible and apply for. To apply complete the small business rates relief application form available online or contact Revenues and Benefits Services on 01642 726006.

The Rateable Value RV of the property that you occupy for business purposes. Crystal Reports - Small Business Rates Relief VO List Application Form_100630_195220rpt Author. Ratepayers of occupied property who are not entitled to mandatory relief with an RV which does not exceed 50999 will have their bill calculated using the lower small business non-domestic rating multiplier.

This is the case even if you do not get small business rate relief. Or by E-MAIL to. National Non Domestic rates hardship relief application form.

If you think that you may qualify after having read the notes below please complete the application form and return to this office at the address shown as soon as possible. This form may be used for a first application for small business rates relief in a valuation period in respect of a property or for a fresh application that is required because the ratepayer has. Please ensure you maintain payments to your Business Rates account in accordance.

You can only get relief. The Government introduced the Small Business Rate Relief SBRR scheme to ease the National Non Domestic Rate NNDR burden on small businesses. The account numbers of any other business properties you pay business rates for in England.

Application forms and information for Business Rates reductions. The application form may be used for a first application for Small Business Rate Relief or for a fresh application that is required because the ratepayer has. Non-Domestic Rating Small Business Rate Relief Amendment England Order 2006 SI 20093175.

Https Www Sba Gov Sites Default Files Files Resourceguide 2822 Pdf

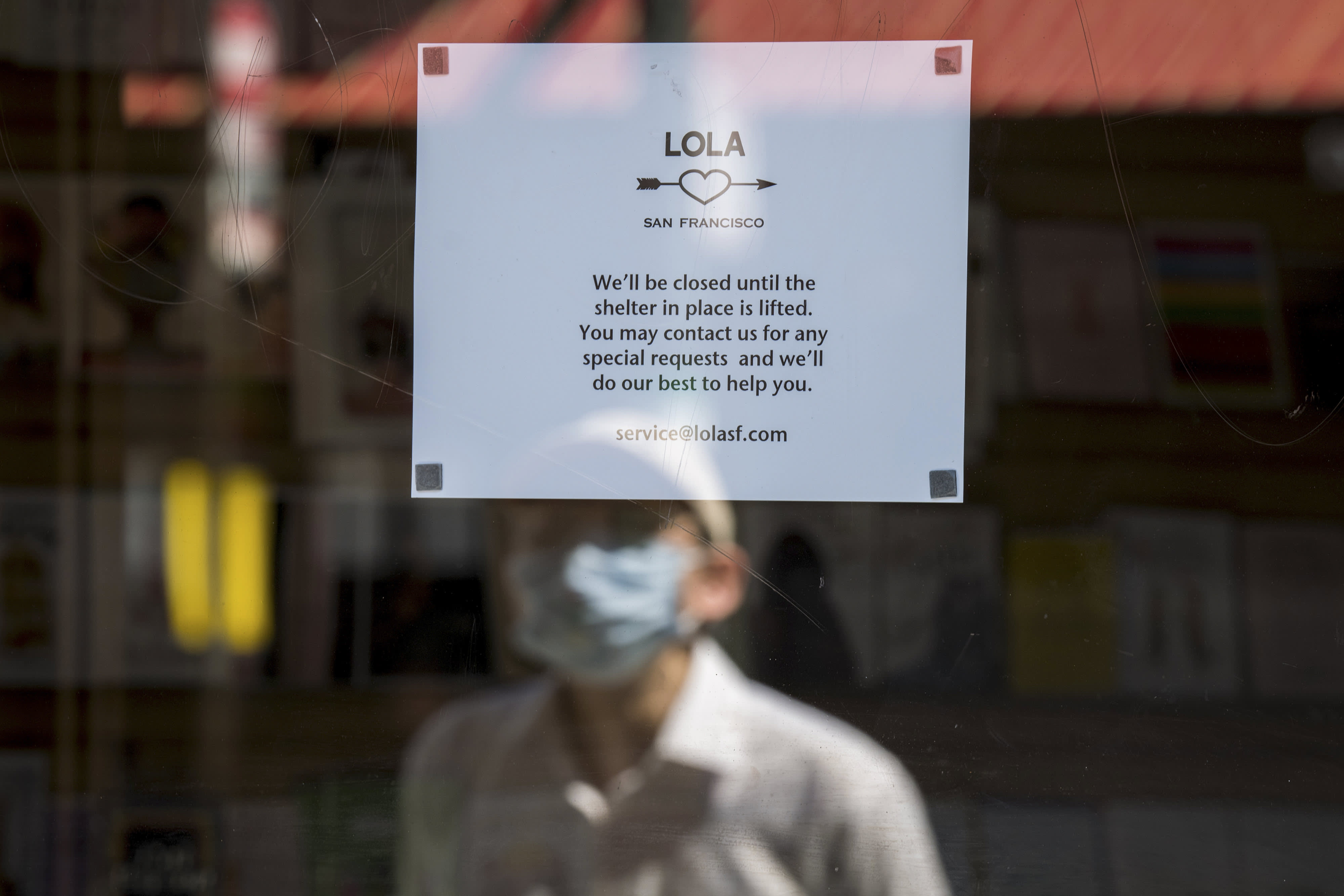

How Small Businesses Can Survive Coronavirus Without Federal Loans

How Small Businesses Can Survive Coronavirus Without Federal Loans

Https Www Aafp Org Content Dam Aafp Documents Practice Management Covid 19 Covid19 Financial Assistance Pdf

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus Covid 19 Hub Miamitimesonline Com

Small Business Relief Tracker Funding Grants And Resources For Business Owners Grappling With Coronavirus Covid 19 Hub Miamitimesonline Com

Congresswoman Terri Sewell Representing The 7th District Of Alabama

Congresswoman Terri Sewell Representing The 7th District Of Alabama

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Us States Small Business Support Amid The Coronavirus Pandemic Best Accounting Software

Us States Small Business Support Amid The Coronavirus Pandemic Best Accounting Software

Recent Changes That Impact Payroll For Small Businesses Ideas

Recent Changes That Impact Payroll For Small Businesses Ideas

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Https Www Sba Gov Sites Default Files Files Resourceguide 2822 Pdf

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

Covid Small Business Resources Page Colorado Small Business Development Center Network

How To Get Help In Alabama During The Covid 19 Crisis Alabama Arise

How To Get Help In Alabama During The Covid 19 Crisis Alabama Arise