Does Pc Get A 1099

Form 1099-MISC is used to report rents royalties prizes and awards and other fixed determinable income. LLC and has not taken the S Corp election LLP.

1099 Tax Document Income Statement Income Tax

1099 Tax Document Income Statement Income Tax

For example payment to your doctor does not require a 1099.

Does pc get a 1099. A professional corporation except for law firms. Companies usually arent required to issue 1099s to corporate entities such as PLLCs that provide professional services to them just as theyre not required to file 1099-MISC forms for corporations. And this is true.

The Internal Revenue Service mandates that all businesses large and small corporations limited liability companies nonprofits and partnerships provide 1099s to certain service providers and independent contractors not long after the end of the tax year. You do not need to send a Form 1099-MISC to. So do not issue a 1099 for credit card payments since this will result in double reporting.

This form is required for filing your taxes. Due to the high level of administrative reporting for corporations the IRS exempts corporations from needing to receive a Form 1099-MISC. The information in this article is intended to be a general overview and not to be used as detailed instructions for completing this form.

This includes S-Corporations and C-Corporations -- they also dont receive 1099 1099-MISCs. You only need to give 1099s if you are using the expense on your business or farm. The designation of PC stands for Professional Corporation and generally firms that have that designation as part of their name are in fact registered as corporations.

The IRS regulations for Form 1099-MISC are complex and every business situation is unique. In most cases companies only need to send 1099-MISCs to a contractor who has received more than 600 in payments for a calendar year. See above and payments for medical or health care services see page 6 of the instructions.

A 1099 form is typically intended for individuals to file when they provide services or goods to a company. In general you dont have to issue 1099-NEC forms to C-Corporations and S-Corporations. The exception to this rule is with paying attorneys.

If they check any box other than b then you send them a 1099 form. Only private corporations that provide services under certain provisions need to receive 1099s. To help you navigate the form check out the following guides.

Information about Form 1099-MISC Miscellaneous Income including recent updates related forms and instructions on how to file. Most corporations dont get 1099-MISCs Another important point to note. The answer is no because the kitchen remodeling was for personal not business reasons.

A 1099 is only required for payments that are not paid by credit card. A limited liability company that has elected to be taxed as a C corporation. In this case the contractor is filing as an individual without a business structure.

If your attorney has exceeded the threshold they receive a 1099 whether theyre incorporated or not. REPORT a 700 purchase of computer repair services from Joness Computers independent contractor. However a few exceptions exist that require a.

You do not need to issue 1099s for personal expenses. 1099 Forms If your account had more than 10 in dividends or more than 20 in sales during the tax year you received IRS Form 1099-DIV or 1099-B from Computershare. A 1099 is also not required for payments to corporations.

There is a separate reporting system in place where the credit card processor reports all payments made on a 1099-K. DO NOT REPORT a 700 purchase of computer repair services from Best Buy corporation. There is no need to send 1099-MISCs to corporations.

You may begin to receive these documents as a. Do you need to issue a 1099-NEC. Typically youll receive a 1099 because you earned some form of income from a non-employer source.

1099-MISCs should be sent to single-member limited liability company or LLCs or a one-person Ltd. However payment to the doctor for drug testing required in your. Get help from a tax professional or use tax preparation software to prepare this form.

In most circumstances 1099-MISC are filed only when a company pays an individual or a partnership. But again the requirement is that you have them fill out the W-9 to have them actually indicate their tax status. If a company pays with a credit card or uses a third party network they would send a 1099-K not the 1099-MISC.

For truck repairs and parts the 1099 is for the total cost of service and parts. Businesses file a 1099-MISC when purchasing services not goods from unincorporated vendors not corporations. Its a common belief that businesses dont need to send out 1099-NEC forms to corporations.

Sole proprietors may not operate as a business entity but the company might still file the 1099 for them. You will need to provide a 1099 to any vendor who is a. 1099s you must send are as follows.

How Amazon Sellers Find Tax Form 1099 K Tax Forms Amazon Seller Amazon Tax

How Amazon Sellers Find Tax Form 1099 K Tax Forms Amazon Seller Amazon Tax

Https Www Idmsinc Com Pdf 1099 Nec Pdf

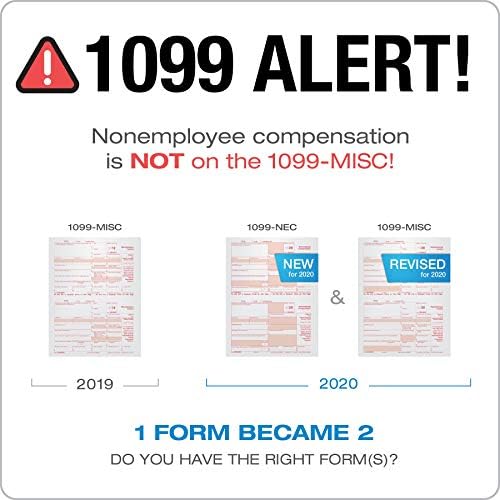

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

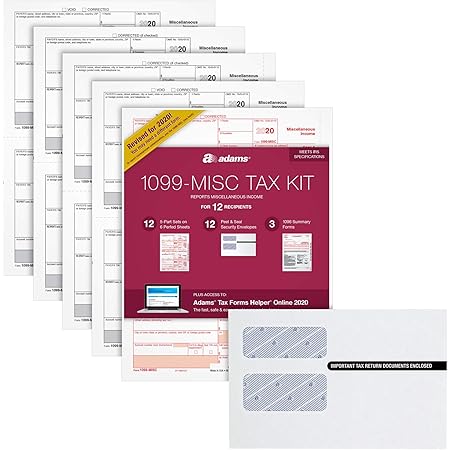

Amazon Com Adams 1099 Misc Forms 2020 Tax Kit For 12 Recipients 5 Part Laser 1099 Forms 3 1096 Self Seal Envelopes Tax Forms Helper Online Txa12520 Misc White 8 1 2 X 11 Office Products

Amazon Com Adams 1099 Misc Forms 2020 Tax Kit For 12 Recipients 5 Part Laser 1099 Forms 3 1096 Self Seal Envelopes Tax Forms Helper Online Txa12520 Misc White 8 1 2 X 11 Office Products

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do Llcs Get A 1099 During Tax Time Incfile

Do Llcs Get A 1099 During Tax Time Incfile

Amazon Com Adams 1099 Misc Forms 2020 Tax Kit For 12 Recipients 5 Part Laser 1099 Forms 3 1096 Self Seal Envelopes Tax Forms Helper Online Txa12520 Misc White 8 1 2 X 11 Office Products

Amazon Com Adams 1099 Misc Forms 2020 Tax Kit For 12 Recipients 5 Part Laser 1099 Forms 3 1096 Self Seal Envelopes Tax Forms Helper Online Txa12520 Misc White 8 1 2 X 11 Office Products

Sage 50 Accounting Transfer To New Computer Sage 50 Sage Company

Sage 50 Accounting Transfer To New Computer Sage 50 Sage Company

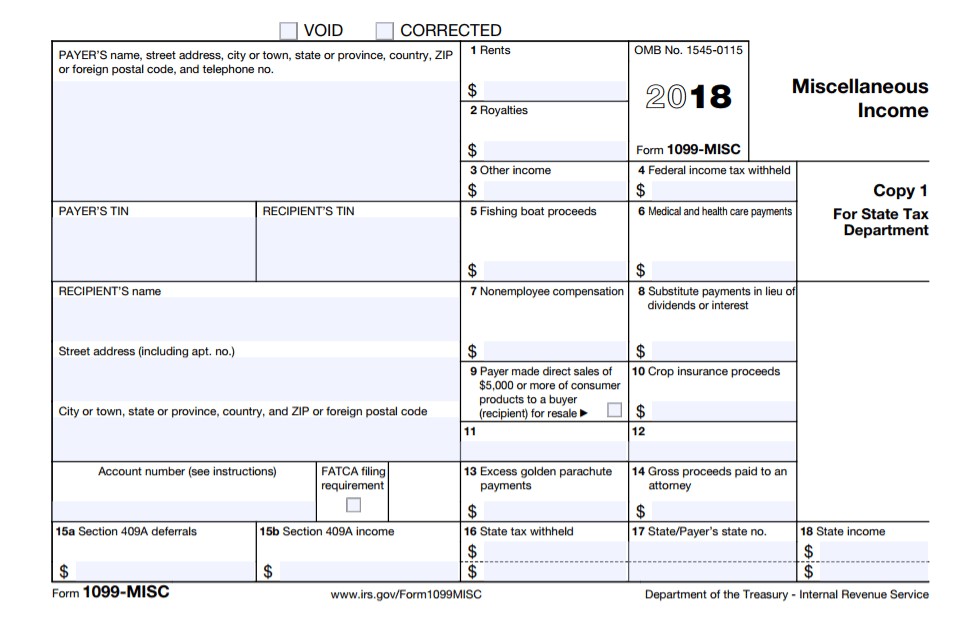

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

Need To File 1099 Misc For 2018 What You Need To Know S J Gorowitz Accounting Tax Services P C

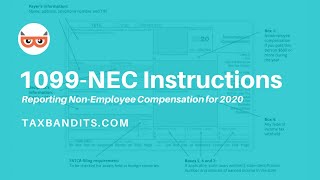

Form 1099 Nec Instructions Reporting Non Employee Compensation For 2020 Taxbandits Youtube

Form 1099 Nec Instructions Reporting Non Employee Compensation For 2020 Taxbandits Youtube

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Do You Need To Issue A 1099 To Your Vendors Accountingprose

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Submit The Irs Form 1099 Misc Online Get Fillable And Printable Miscellaneous Income Template With Detailed Instructions E Fillable Forms Irs Forms Tax Forms

Submit The Irs Form 1099 Misc Online Get Fillable And Printable Miscellaneous Income Template With Detailed Instructions E Fillable Forms Irs Forms Tax Forms

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com

Irs Approved 1099 Misc 4 Part Continuous Tax Form Walmart Com Walmart Com

Amazon Com Adams 1099 Nec Forms 2020 Tax Kit For 12 Recipients 5 Part Laser 1099 Forms 3 1096 Self Seal Envelopes Tax Forms Helper Online Txa12520 Nec White 8 1 2 X 11 Office Products

Amazon Com Adams 1099 Nec Forms 2020 Tax Kit For 12 Recipients 5 Part Laser 1099 Forms 3 1096 Self Seal Envelopes Tax Forms Helper Online Txa12520 Nec White 8 1 2 X 11 Office Products

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

The Irs Resurrects Form 1099 Nec After A 38 Year Absence

2015 W2 Fillable Form Fillable Form 8959 Additional Medicare Tax 2015 Fillable Forms Power Of Attorney Form W2 Forms

2015 W2 Fillable Form Fillable Form 8959 Additional Medicare Tax 2015 Fillable Forms Power Of Attorney Form W2 Forms