Can You Claim Expenses Without Receipts Uk

If you cannot prove that you only used the car for business then HMRC will assume that. Nov 13 2016 No receipt no claim.

What Are Business Expenses What Expenses Can I Claim

What Are Business Expenses What Expenses Can I Claim

Do you need one.

Can you claim expenses without receipts uk. Firstly the expense must be allowable. If you know for sure that you do not have any receipts for your tools then you can still claim a flat rate expense. The answer is ideally yes but you can still claim without one.

You might still be able to claim those items even without a receipt. Apr 06 2021 You can claim the VAT element of business calls in case you are VAT registered. But you should keep proof and records so you can show them to HM Revenue and Customs HMRC if asked.

However you cannot claim line rental as this cost is fixed. HMRC rules state that expenses can be claimed provided they are wholly and exclusively for the purposes of your contract. Unless you can prove that you used the full tank of fuel that you purchased with your fuel receipt for business miles say for example you put a tank of fuel in a hire car or perhaps the car is parked at the business premises and is never used for personal mileage then you cannot claim for the fuel receipt.

Jun 15 2017 You could of course claim anything without a receipt and simply hope the taxman never asks to see proof. However it depends what kind of business youre in. So the company involved created an unreceipted expense claim policy which was approved by the Directors and said that in exceptional circumstances a maximum claim of 10 per day could be made as reimbursement for travel expenses if receipts were not available.

This means you should be able to answer yes to these questions. There are often different amounts set for different sectors. Note that you have to have actual receipts for.

For the self employed allowing a small weekly deduction for laundry use of home as office etc which do not require receipts - however the amounts involved are small probably. May 16 2018 You can claim up to 150 each year on clothing you buy for work. All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts.

Expenses can potentially be claimed if they are not receipted but they must be genuine business expenses. You can also claim for any dry-cleaning fees youve incurred to keep work-related clothing clean. If you use your personal car for a business person you can claim the expenses to get tax relief.

HMRC offers this guidance in the General guide to keeping records for your tax return. Valid expense claims and receipts. This includes the cost of buying branded uniforms protective gear such as boots or sunglasses and high-visibility clothing.

Jan 03 2020 Generally you cant make tax claims without receipts. You do not need to send in proof of expenses when you submit your tax return. Flat rate expenses are a pre-determined amount decided by HMRC that taxpayers in certain industries can claim for specific work expenses.

You cant make tax claims without receipts. You reimburse an employees travel expenses - youll need to keep a record of when and why the employee travelled and where possible keep receipts as evidence. Without the evidence from receipts for your claimed business expenses the Canada Revenue Agency CRA may decide to reduce the number of expenses you have deducted.

But sometimes you cannot get a receipt. There are cases where you can claim a tax deduction without a receipt but there are serious restrictions. Jan 18 2021 The Wise Accountant would also remind you though that its your responsibility to let your accountant know what youve spent money on so it can be claimed back in the right way and to always keep copies of your receipts.

You are allowed to claim 45p for the first 10000 miles and 25p thereafter. Jun 24 2009 You can claim any expense you have incurred in order to provide your trade or services but should you be picked up fr an audit by the tax office and you dont have the relevant receipts then you will have difficulty proving what was spent- that is. Any items valued over 150 and youll need a receipt.

All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts. HMRC confirm that for small cash expenses its sometimes OK to claim for a cash receipt that cant be substantiated. There are many concessions.

Etsy Seller Spreadsheets Shop Management Tool Financial Tax Reporting Profit And Loss Income Expenses Spreadsheet Excel Google Docs Spreadsheet Business Business Tax Deductions Small Business Tax Deductions

Etsy Seller Spreadsheets Shop Management Tool Financial Tax Reporting Profit And Loss Income Expenses Spreadsheet Excel Google Docs Spreadsheet Business Business Tax Deductions Small Business Tax Deductions

Automating Mileage Claims In The Uk Mileage App Mileage Tracking App About Uk

Automating Mileage Claims In The Uk Mileage App Mileage Tracking App About Uk

Marketing Project Request Form Template Inspirational Expenses Claim And Reimbursement Form Sample For Excel Excel Templates Templates Invoice Template

Marketing Project Request Form Template Inspirational Expenses Claim And Reimbursement Form Sample For Excel Excel Templates Templates Invoice Template

How To Claim Expenses When You Re Self Employed Courier

How To Claim Expenses When You Re Self Employed Courier

003 Expense Report Template Monthly Fantastic Ideas Free With Regard To Quarterly Report Template Small Business Expenses Spreadsheet Template Business Expense

003 Expense Report Template Monthly Fantastic Ideas Free With Regard To Quarterly Report Template Small Business Expenses Spreadsheet Template Business Expense

This Is The Toolkit You Should Have Received The Day You Got Your Rental Property The O N E Method Will Show You In 2020 Tax Deductions Finance Saving Helping People

This Is The Toolkit You Should Have Received The Day You Got Your Rental Property The O N E Method Will Show You In 2020 Tax Deductions Finance Saving Helping People

Tax Deductible Expenses Nimble Jack Accounting Tax Deductions Deduction Accounting

Tax Deductible Expenses Nimble Jack Accounting Tax Deductions Deduction Accounting

Teacher Tax Deductions Are Great Ways Of Recouping Costs Teacher Tax Deductions Teacher Organization Teaching

Teacher Tax Deductions Are Great Ways Of Recouping Costs Teacher Tax Deductions Teacher Organization Teaching

Expense Reimbursement Form Template Download Excel Expense Sheet Expenses Printable Printable Invoice

Expense Reimbursement Form Template Download Excel Expense Sheet Expenses Printable Printable Invoice

Can Contractors Claim Expenses Without Receipts

Can Contractors Claim Expenses Without Receipts

Charging Client Expenses How To Do It Correctly Rs Accountancy

Charging Client Expenses How To Do It Correctly Rs Accountancy

Expenses Claim Form Template Uk Ten Lessons I Ve Learned From Expenses Claim Form Template U Templates Lesson Encouragement

Expenses Claim Form Template Uk Ten Lessons I Ve Learned From Expenses Claim Form Template U Templates Lesson Encouragement

Claim Form Template Why Claim Form Template Had Been So Popular Till Now Templates Business Template Spreadsheet Template

Claim Form Template Why Claim Form Template Had Been So Popular Till Now Templates Business Template Spreadsheet Template

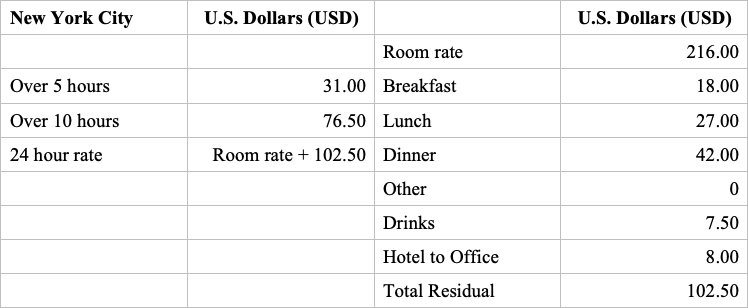

Per Diems For Dummies United Kingdom Rydoo

Per Diems For Dummies United Kingdom Rydoo

Free Expenses Claim Form Excel Template Download Excel Templates Templates Spreadsheet Template

Free Expenses Claim Form Excel Template Download Excel Templates Templates Spreadsheet Template

The Top 5 Questions I Get Asked Goselfemployed Co This Or That Questions Small Business Bookkeeping Tax Questions

The Top 5 Questions I Get Asked Goselfemployed Co This Or That Questions Small Business Bookkeeping Tax Questions

Expense Reimbursement Form Templates 17 Free Xlsx Docs Pdf Samples Excel Templates Templates Tutoring Flyer

Expense Reimbursement Form Templates 17 Free Xlsx Docs Pdf Samples Excel Templates Templates Tutoring Flyer

Self Employed Expenses Explained Goselfemployed Co Small Business Tax Deductions Small Business Tax Business Tax

Self Employed Expenses Explained Goselfemployed Co Small Business Tax Deductions Small Business Tax Business Tax