How To Prepare W2 For Employees In Quickbooks

Select Address and Contact then complete the fields. Click on the Hire Employee link to view resources.

Creating QuickBooks Works Orders.

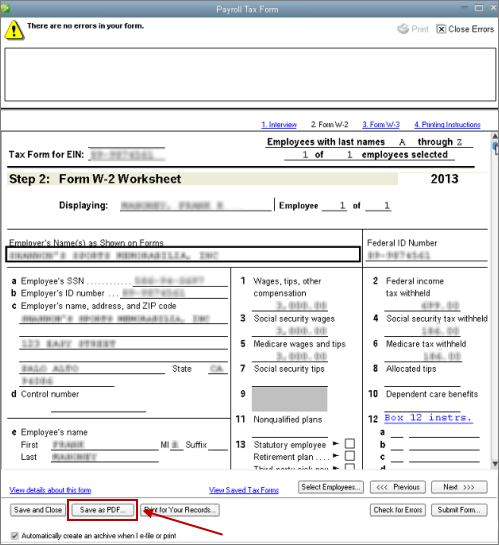

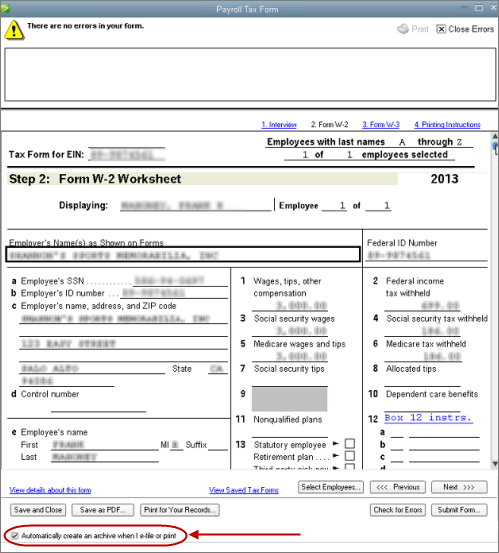

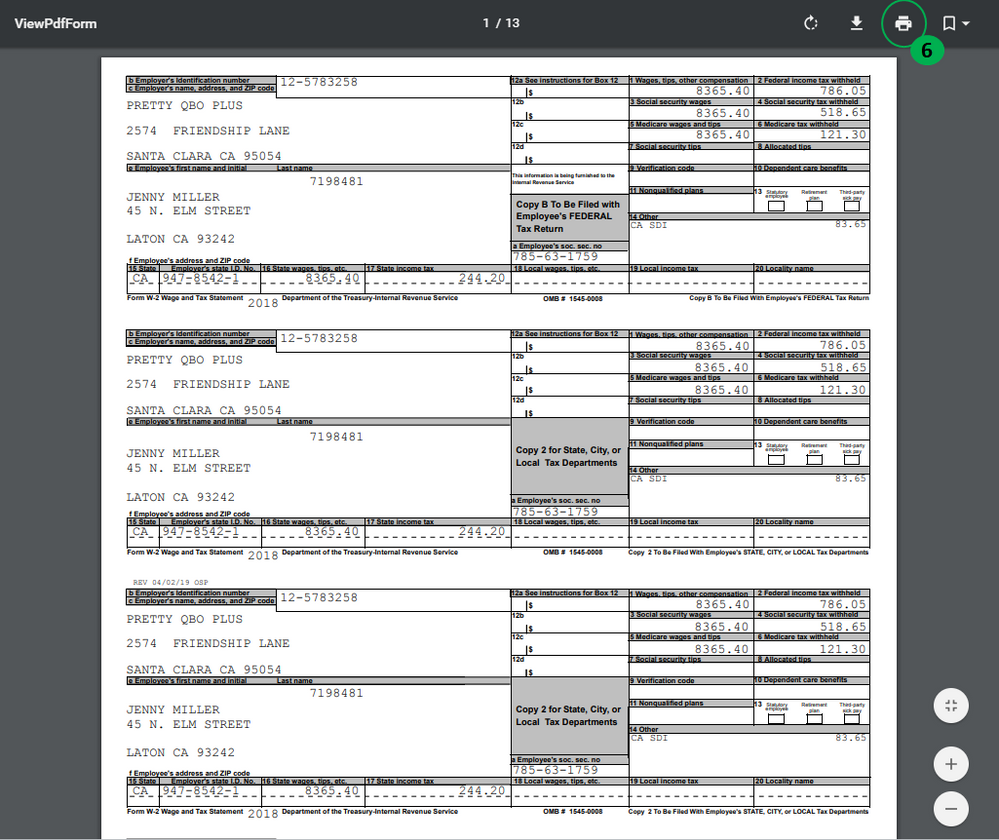

How to prepare w2 for employees in quickbooks. Select the W-2 tab. This year must be before you subscribed to QuickBooks Desktop Payroll Assisted service. Select individual employee names from the list or select the checkbox next to the title Employee to select all employees.

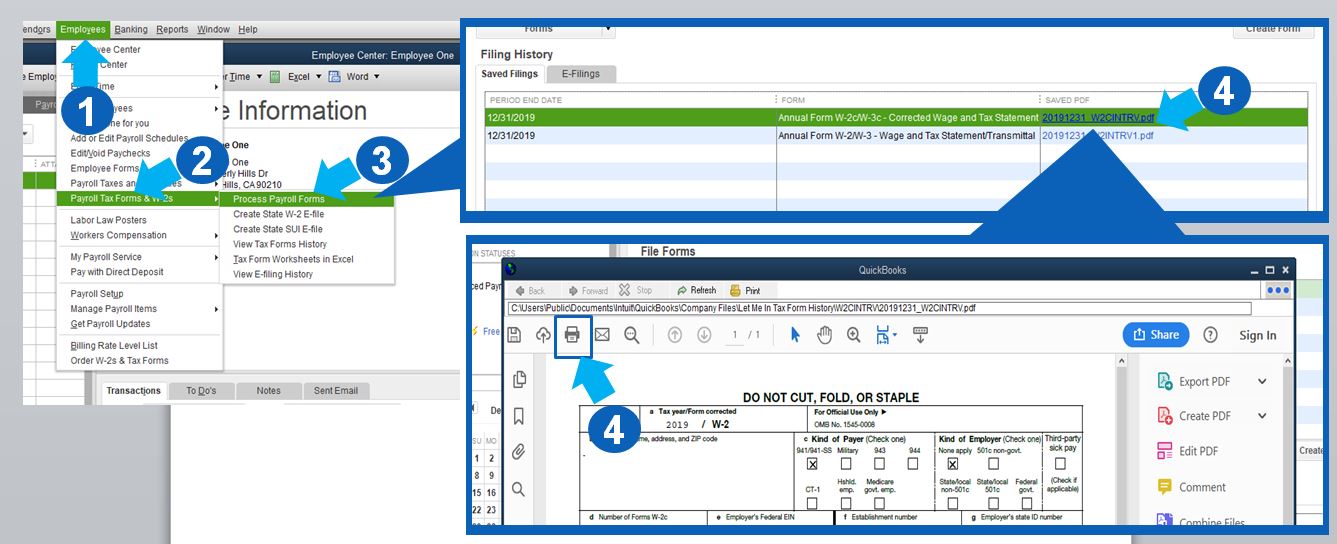

Select Additional Info and enter any information of the employee. On the following screen select how you want to prepare your forms online or on. Choose Employees Payroll Tax Forms W-2s then Process Payroll Forms.

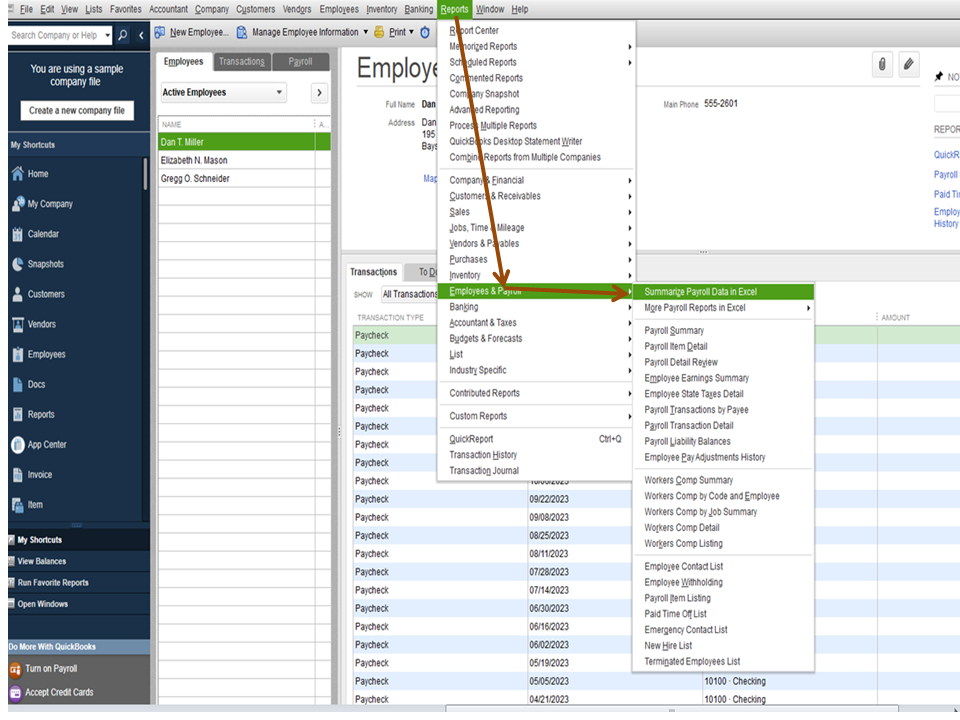

If you are prompted to enable macros in Excel follow the prompts to do so 2. Prepare W-2 Forms Step 1. Enter your business phone number and email address.

Then select process payroll forms from the drop-down menu. Click the Payroll Info tab. Create a Journal Entry.

Select Contractors from the sub-menu and then click Add your first contractor. Select Annual Form W-2W-3 Wage and Tax StatementTransmittal. Access the Payroll Tax Center Choose Employees Payroll Center.

Be sure you have Excel installed on your computer and follow these steps. QuickBooks offers a collection of payroll reports that generate a wealth of information about a companys employees and expenses. Get help with Workforce.

Enter the name and the. If you use QuickBooks Online Payroll and you disabled Allow employees to import W-2 data into TurboTax your employees would not see their W-2 in Workforce. Once you have done that an electronic version of the W-2 will be displayed.

Under Select Filing Period next to Year enter the year for the W-2 forms you want to print and select OK. QuickBooks needs to keep its built-in functionality broad so that small and mid-sized business owners of any kind can use it. Click on payroll items to jump to the Payroll Item List to add items to the list if needed.

From the main dashboard click the Workers tab on the left-hand side. Select the appropriate employee and click on OK. Enter the particular employees.

Quickbooks offers journal entries as a way to record reimbursements. QuickBooks used to calculate each box on the W-2. In Quickbooks you can record a reimbursement to an employee in a few easy steps.

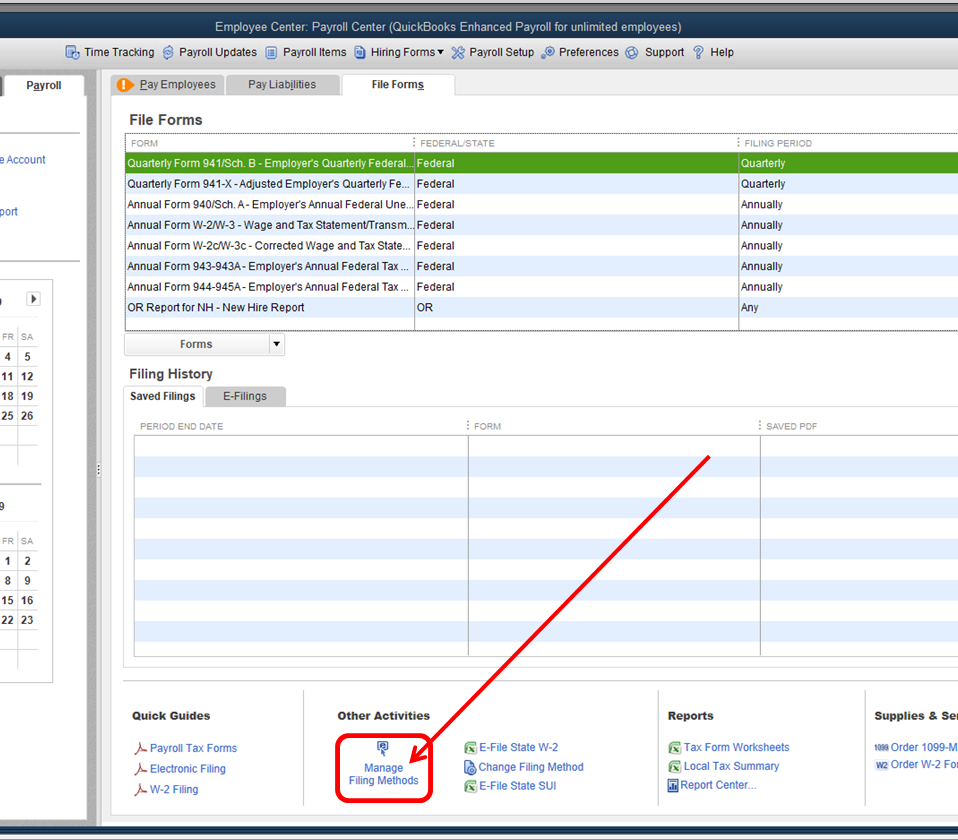

Click the File Forms tab. This should only be done when instructed by the Canada Revenue Agency or other government authority. Click the box Use Time Data to Create Paychecks.

In the Select Employees for Form W-2W-3 window select the employees. These reports can provide information about general staff or about individual employees and can be easily exported to share and diversify uses for the data. QuickBooks Online Payroll 11 NOTE In rare cases you can make an employee exempt from paying CPP and EI.

Since the QuickBooks system does not allow you to change from employee to vendor to implement this change you can either delete the original employee name and then create a new one of the vendor type or can make the existing employee name inactive before creating a new one of. Select the Personal tab and complete the fields. Enter Account use Employee Loan or similar other current asset Second Part.

From the menu choose annual form W-2W-3 wage and tax statement. On the File Forms tab of the Payroll Center click. Check the box Allow employees to import W-2 data into TurboTax.

You may need to file your state W-2s separately. Select New Employee and enter their information in the needed areas. Go into Employee Center.

Then click on Pay tax forms and W-2s. Click on the Raises and Promotions link to adjust the employees hourly rate title or relevant payroll item. Enter your QuickBooks account and click on employees from the menu.

Enter your payroll PIN. You can create a new journal entry in Quickbooks Online by selecting the Create button on the home screen followed by Journal Entry. Select Settings then Payroll Settings.

Click Prepare W-21099 near the bottom of the opening screen. Go to Employees in Payroll Center. Double click on employee name.

Open W-2 Form Choose Employees Payroll Tax Forms W-2s Process Payroll Forms from the QuickBooks menu. Click ViewPrint Forms W-2s. File your W-2s with your state.

Select E-File Federal Forms. Review W-2s Click. Scroll to the Employee.

In the Reports area near the bottom of the page. To print W-2 forms with the Self Print option. Choose Employees Click to place a check to the left of each employee for whom you want to prepare a W-2 form.

To report your W-2 income in QuickBooks follow the instructions below. Go to Employees then select Employee Center. There is no perfect built-in solution for creating work orders in QuickBooks because the software wasnt explicitly designed for the needs of the field service industry.

You can also select Mark All to select all employees displayed. Pay to the order of the Employee but listed as a vendor. To set up a 1099 employee in QuickBooks Online follow the below steps.

To do this click the Tax exemptions down arrow and make the appropriate selections. Proceed to select federal forms and then click on ok. In the section titled Shared Data select Edit.

Using Quickbooks To Print W2s Experts In Quickbooks Consulting Quickbooks Training By Accountants

Using Quickbooks To Print W2s Experts In Quickbooks Consulting Quickbooks Training By Accountants

How To Print W2 In Quickbooks Online

How To Print W2 In Quickbooks Online

Form W 2 1099 How To Export Employees From Quickbooks

Form W 2 1099 How To Export Employees From Quickbooks

How To Your Guide To W 2s For 2020 Taxes Quickbooks Online Youtube

How To Your Guide To W 2s For 2020 Taxes Quickbooks Online Youtube

Using Quickbooks To Print W2s Experts In Quickbooks Consulting Quickbooks Training By Accountants

Using Quickbooks To Print W2s Experts In Quickbooks Consulting Quickbooks Training By Accountants

Quickbooks W2 Form Setup Prepare Print E File Deadline Date

Quickbooks W2 Form Setup Prepare Print E File Deadline Date

Using Quickbooks To Print W2s Experts In Quickbooks Consulting Quickbooks Training By Accountants

Using Quickbooks To Print W2s Experts In Quickbooks Consulting Quickbooks Training By Accountants

Quickbooks W2 And Year End Payroll Quickbooks W 2 Checklist

Quickbooks W2 And Year End Payroll Quickbooks W 2 Checklist

How To Efile W2 And W3 Tax Forms With Ssa Using Quickbooks

2020 Quickbooks W2 Double 4 Down Blank Perforated Tax Forms With Envelopes

2020 Quickbooks W2 Double 4 Down Blank Perforated Tax Forms With Envelopes