How To Increase Personal Loan Tenure Hdfc

Adjust the variables according to your requirement. The applicant should have the.

Ways To Increase Your Hdfc Personal Loan Tenure By Mymoneymantra Medium

Ways To Increase Your Hdfc Personal Loan Tenure By Mymoneymantra Medium

With low EMIs payments every month you need to pay more interest on longer personal loan tenure.

How to increase personal loan tenure hdfc. HDFC Bank also offers a host of benefits for first-time loan customers Enjoy the flexibility to pick a tenure that suits you and pay back the loan in pocket-friendly EMIs Use our Personal Loan EMI Calculator to check your monthly outgo. Sep 04 2019 Paying a loan through its tenure or making a prepayment on pre-closure are the options available to you when you take a personal loan. You need to pay EMIs throughout the loan tenure till you have paid off your home loan.

Mar 28 2020 How Can You Approach HDFC for a Change in Your Housing Loan Tenure. You can use the calculator to calculate the EMI on a personal loan from any bank or financial institution. To be eligible for a Personal loan Top Up from HDFC Bank the following criteria should be met.

Increasing the interest rate or loan amount will increase your EMI while increasing the tenure will reduce the EMI. Longer Personal Loan Tenure. NRI should input net income.

You need to pay more interest on longer personal loan tenures as you have many EMIs to pay. -- Gross Income Monthly in Rs. Once the process is complete you will need to ask them for an amortization schedule for the revised home loan EMI and tenure.

This is an effective trick to reduce your loan tenure and in turn the interest cost. You can visit the branch of HDFC Limited or HDFC Bank with the latest loan statement indicating the principal and interest repayment made so far the outstanding balance left to service etc. Is this calculator only for HDFC Bank personal loans.

In longer personal loan tenure the payments of your EMIs payments will be reduced but increases your overall interest payments on number of EMIs. Already running a personal loan from HDFC Bank you can apply for extra loan amount when needed as a Top Up on the existing loan. When applying for a Balance Transfer of your personal loan to HDFC Bank the tenure of your personal loan can be reworked to suit your ability to pay back the loan.

Thus the amount of instalment will increase with the tenor of the loan. To increase of decrease any of the variables just use the sliders. Apr 22 2020 HDFCs Eligibility Calculator facilitates checking eligibility for housing loans online.

The decision is. Pay back your fast to save paying extra interest. They will ask you to fill out a form and pay a small processing fees to do the same.

Pay later on either in full or settle at mutually arrived figureUnless you pay in full including penalty charges settling the. Dec 28 2018 Its a simple process you will need to contact your bank and tell them that you need to reset your home loan tenure. The Maximum tenure allotted is 60 months.

A longer tenure helps in enhancing the eligibility. Just enter three key inputs loan amount term and interest and the calculator will automatically do the calculations for you. Here in this article we will find out how a pre-existing HDFC Personal Loan consumer can increase the loan tenure.

The EMI of the existing loan should be paid on time. You can choose to repay in any of these ways. A Personal loan Top up is an additional loan amount added to a pre existing loan.

Additional finance is available under the umbrella of the previous loan as a Top Up. May 28 2020 The HDFC Step-up EMI repayment feature will allow customers to service a lower EMI for 12 months. Personal Loan Top Up from HDFC Bank.

Input the desired loan term for which you wish to avail the loan. In case of a partly disbursed loan the fee payable to avail the conversion shall be 025 plus applicable taxes of the principal outstanding plus the undisbursed loan amount or 5000 plus applicable taxes. -- Loan Tenure In Years.

HDFC offers you an option to convert your existing adjustable rate to HDFCs current adjustable rate by effectuating a change in the spread as indicated in the loan agreement. To increase of decrease any of the variables just use the sliders. You cannot increase tenure as this is a fixed interest loanYou are starting at penalties for defaultingThis will hit your cibil scoreRemember cibil score is imp if you plan to take any type of loan against or plan to go abroadOtherwise its uselessYou can default.

You can align this increase with your increase in salary or receiving any other annual bonus. 3 or more EMI of the existing loan must be paid before a Top Up can be sanctioned. Increasing your EMI amount by 5 every year is definitely a smart choice to reduce your interest repayment burden.

Jun 12 2019 You get enough flexibility to choose the loan amount tenure and EMI. Input gross monthly income. Increasing the interest rate or loan amount will increase.

The EMIs will increase by 10 after completing a year. Each EMI is made up of interest payable on your loan and part principal repaymentAlthough the EMI remains a fixed sum throughout the loan tenure during the initial years the interest component of the EMI is higher and the loan repayment component is lower. HDFC Bank provides a minimum tenure of 12 months for repayment of a personal loan.

Sbi Personal Loan Interest Rates Quikkloan Blog

Sbi Personal Loan Interest Rates Quikkloan Blog

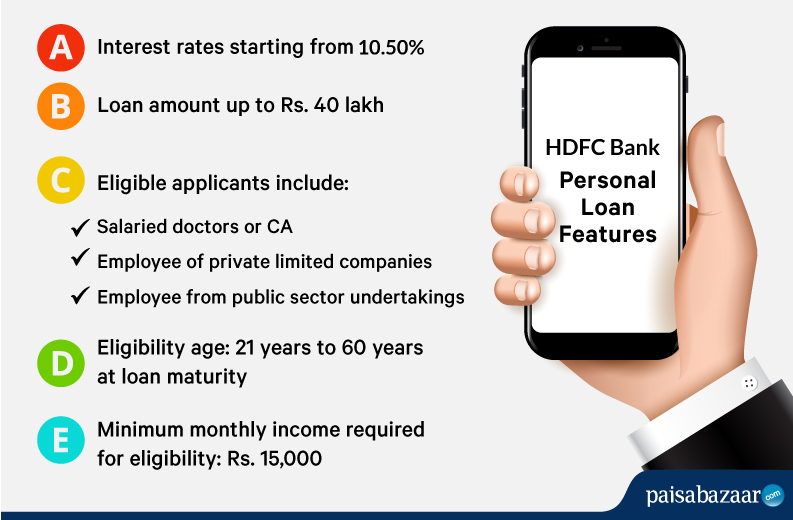

Hdfc Personal Loan 10 50 Interest Rate Eligibility Apply Online

Hdfc Personal Loan 10 50 Interest Rate Eligibility Apply Online

How Pre Closure Of Personal Loan Can Impact Your Credit Score

How Pre Closure Of Personal Loan Can Impact Your Credit Score

Citibank Personal Loan 9 99 Interest Rate Eligibility Apply Online

Citibank Personal Loan 9 99 Interest Rate Eligibility Apply Online

What Are The Features And Benefits Of Hdfc Bank Personal Loans Daily Bayonet

What Are The Features And Benefits Of Hdfc Bank Personal Loans Daily Bayonet

Personal Loan Everything You Need To Know About Personal Loan Hdfc Bank

Personal Loan Everything You Need To Know About Personal Loan Hdfc Bank

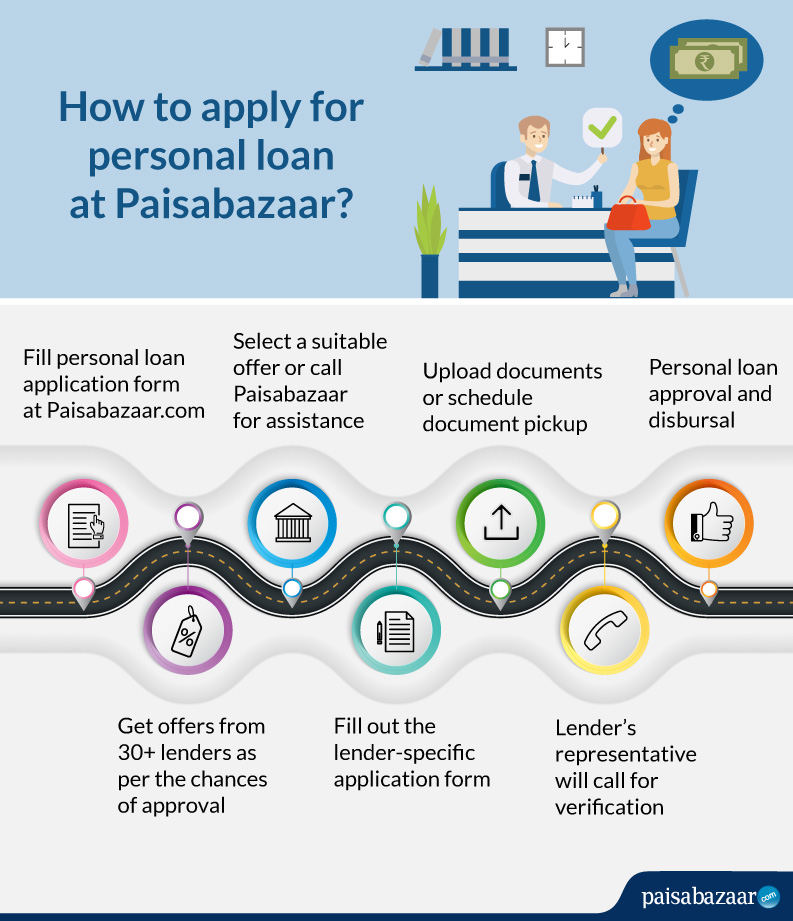

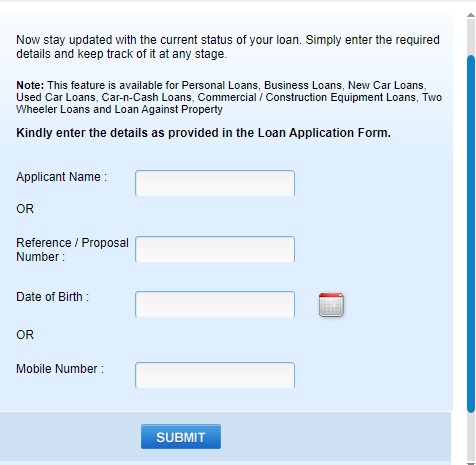

Check Hdfc Personal Loan Application Status Online Fincity

Check Hdfc Personal Loan Application Status Online Fincity

Hdfc Personal Loan Emi Calculator Have You Used It Finance Consultant

Hdfc Personal Loan Emi Calculator Have You Used It Finance Consultant

Hdfc Personal Loan 10 50 Interest Rate Eligibility Apply Online

Hdfc Personal Loan 10 50 Interest Rate Eligibility Apply Online

Personal Loan On Speed The Pre Approved Personal Loan

Personal Loan On Speed The Pre Approved Personal Loan

Hdfc Bank Personal Loan Covid 19 Moratorium Emi Period How To Apply Status

Hdfc Bank Personal Loan Covid 19 Moratorium Emi Period How To Apply Status

What Is The Processing Time For An Hdfc Personal Loan Quora

Hdfc Personal Loan Preclosure Things You Need To Know

Hdfc Personal Loan Preclosure Things You Need To Know

How To Apply For Hdfc Loan Restructuring Online Hdfc Loan Restructuring Link Youtube

How To Apply For Hdfc Loan Restructuring Online Hdfc Loan Restructuring Link Youtube

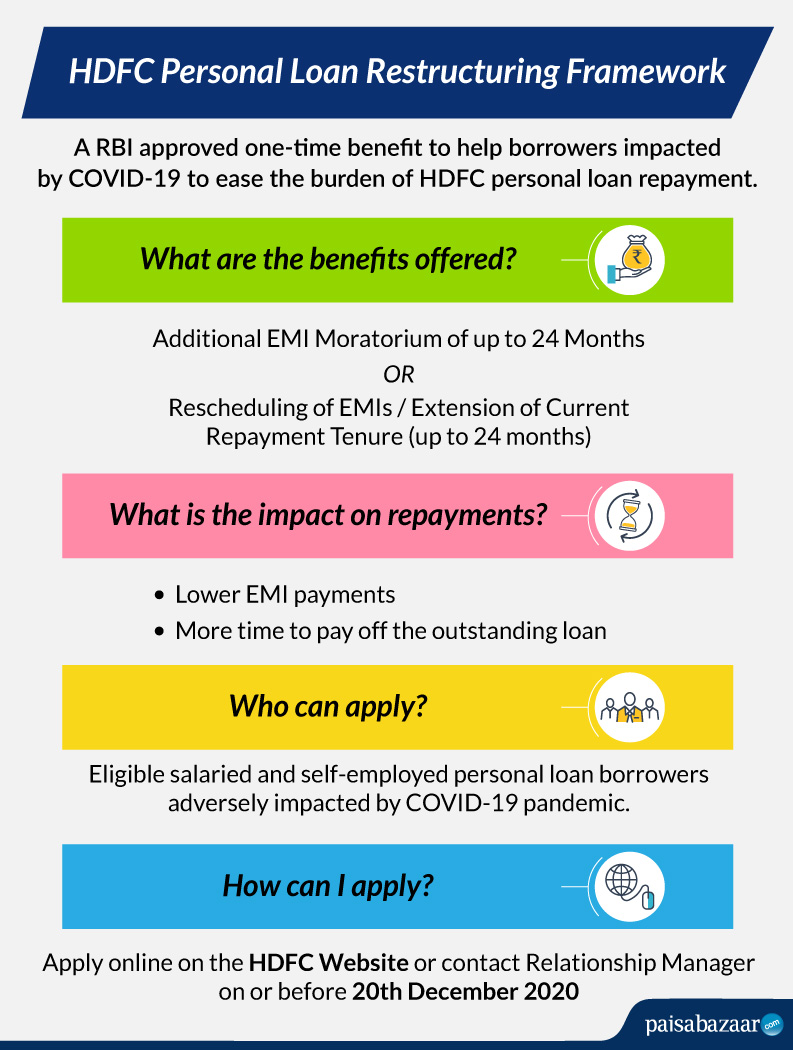

Hdfc Personal Loan Restructuring Covid 19 Paisabazaar Com

Hdfc Personal Loan Restructuring Covid 19 Paisabazaar Com

Hdfc Business Loan Interest Rates 15 Check Eligibility Docs Required Apply Online

Hdfc Business Loan Interest Rates 15 Check Eligibility Docs Required Apply Online

Hdfc Bank Insta Jumbo Loan Our Review Emi Calculator

Hdfc Bank Insta Jumbo Loan Our Review Emi Calculator

Emi Calculator India Information About Loans Investment Mortgage Insurance

Emi Calculator India Information About Loans Investment Mortgage Insurance

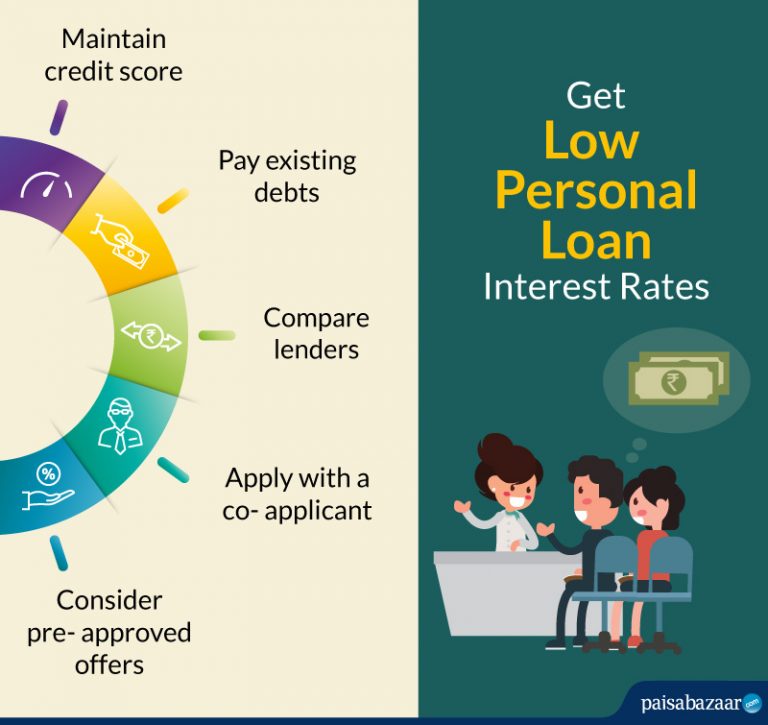

Tips To Get The Best Deal On Your Personal Loan Interest Rate

Tips To Get The Best Deal On Your Personal Loan Interest Rate