How To File 1099-misc With California

The IRS will not be sending copies of the new Form 1099-NEC Nonemployee Compensation to California or any other state. You are required to file a Form 1099-MISC for the services performed by the independent contractor.

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Wade Howard Associates Cpas Llp

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Wade Howard Associates Cpas Llp

Request 1099-MISC Forms By Mail You can request the IRS to mail the forms to you.

How to file 1099-misc with california. Check the 1099 online reporting requirements for California and e-file in minutes. You may receive a 1099-MISC if you received at least 600 for. A service-recipient means any individual person corporation association or partnership or agent thereof doing business in this state deriving trade or business income from sources.

Heres how to file an amended tax return. The recipient is a California resident or part-year resident. Department of the Treasury Internal Revenue Service Center Ogden UT 84201.

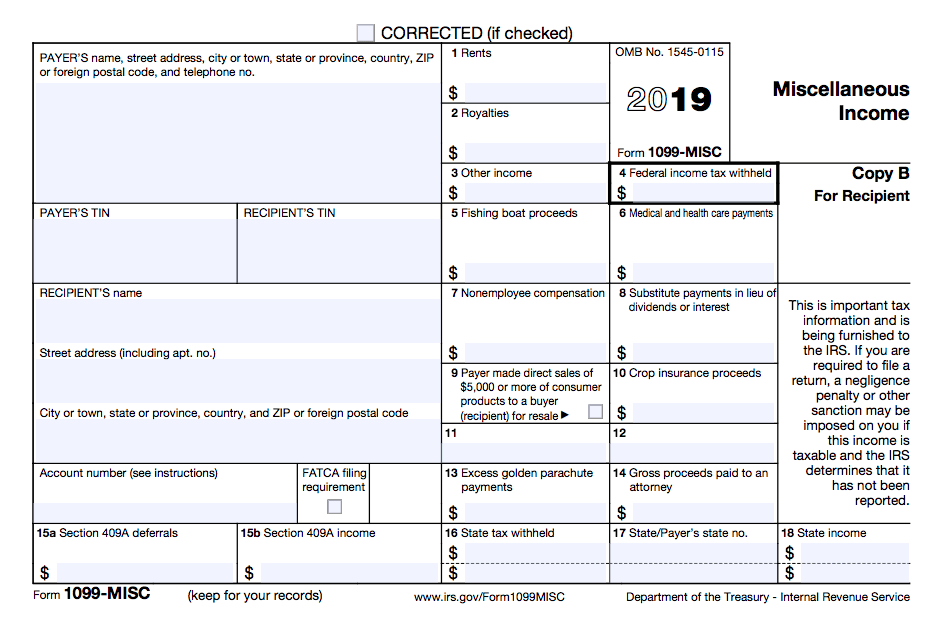

File Form 1099-MISC by March 1 2021 if you file on paper or March 31 2021 if you file electronically. The source of a 1099 transaction was in California. Specific Instructions for Form 1099-MISC File Form 1099-MISC Miscellaneous Income for each.

E-file Form 1099-NEC MISC INT DIV directly to the California State agency with TaxBandits. As far as that link you provided this would not be considered a reliable link for tax information. As of this moment since QuickBooks doesnt file 1099s with the states youll need to check with your state agency for filing requirements.

The only exception would be if you performed work in another state and the 1099 MISC was issued from a California address. Franchise Tax Board PO Box 942840 Sacramento CA 94240-6090. We file to all states that require a state filing.

This income will be included in your federal adjusted gross income which you report to California. California uses the same filing deadlines as. You need to file a California State return from a 1099 MISC if it is for work that was performed in California.

This link explains this phenomenon. Let us manage your state filing process. A service-recipient is any business or government entity that is required to file a federal Form 1099-MISC for services performed by an independent contractor.

When filing state copies of forms 1099 with California department of revenue the agency contact information is. Remember that you have to send such a request at least 30 days before the due date ie. Once you pay the independent contractor 600 or more OR enter into a contract for 600 or more then you have 20 days to report the independent contractor to the EDD.

EFile California 1099-MISC 1099-K 1099-NEC directly to the California State agency with Tax1099. 31 st of January 2021. Use this link to request the IRS for your 1099-MISC forms and other forms.

California is not on the list of states which doesnt require to file Form 1099-MISC. Report the amount indicated on the form as income when you file your federal return. The IRS will continue to send all other Forms 1099 to the states As a result businesses must send copies of Form 1099-NEC directly to the FTB even if a copy was filed with the IRS.

Yes youre right. You pay the independent contractor 600 or more or enter into a contract for 600 or more. If youre mailing the forms to the IRS send them out no later than the last day of February.

IRS approved Tax1099 allows you to eFile California forms online with an easy and secure filing process. The 1099-MISC forms must be mailed to your vendors by January 31. An Irvine California-based financial institution.

When filing federal copies of forms 1099 with the IRS from the state of California the mailing address is. Section 6071c requires you to file Form 1099-NEC on or before February 1 2021 using either paper or electronic filing procedures. The independent contractor is an individual or sole proprietorship.

How you report 1099-MISC income on your income tax return depends on the type of business you own. This helps the department looking for parents who are behind on paying child support. In California you are required to report any 1099s to the Employment Development Department EDD.

If you are a sole proprietor or single-member LLC owner you report 1099 income on Schedule CProfit or Loss From Business. Why Did I Receive Form 1099-NEC Instead Of Form 1099-MISC This Year. This Tutorial will demonstrates how to E-File the 1099-Misc forms to California by creating a Batch and submitting the file to a third-party vendor.

Choose Expenses from the left menu then select Vendors. Enter all information correctly for the tax year then hit Next until youve to. Visit IRSs A Guide to Information Returns for more information.

If youre filing electronically you can submit the forms by March 31. You need to file an information return with us if either of the following are true.

1099 Misc Form Copy C 2 Recipient State Zbp Forms

1099 Misc Form Copy C 2 Recipient State Zbp Forms

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg) Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Misc Form Copy A Federal Discount Tax Forms

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

Printable And Fileable Form 1099 Misc For Tax Year 2017 This Form Is Filed By April 15 2018 Fillable Forms Irs Forms 1099 Tax Form

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

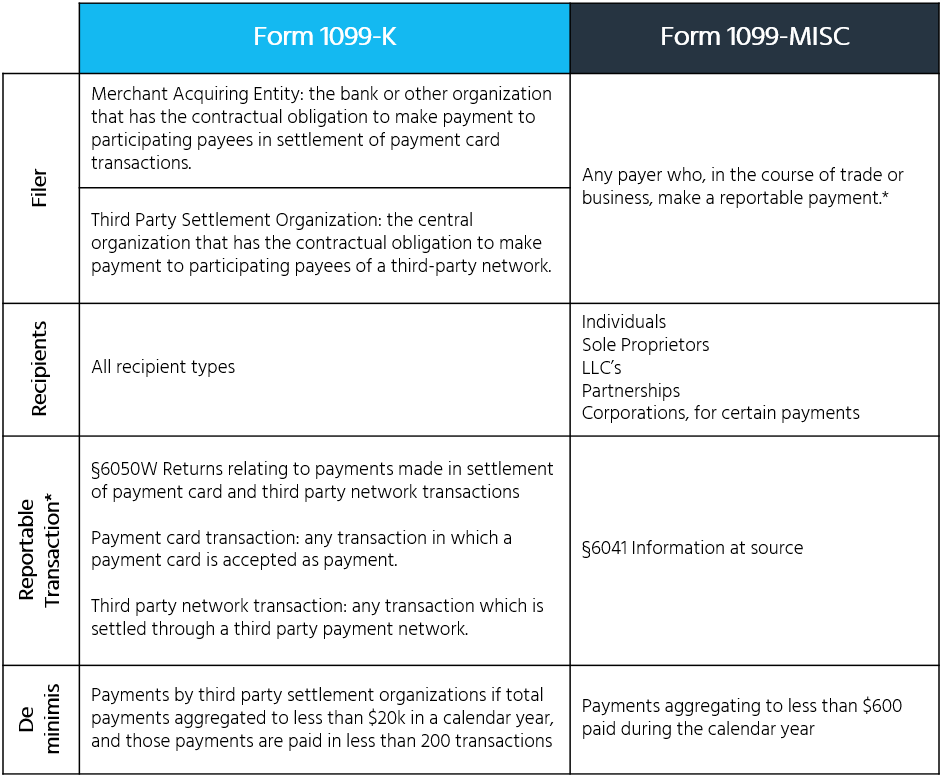

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

Irs Forms 1099 Misc Vs 1099 K States Close Tax Reporting Gap Sovos

1099 Misc Form Copy B Recipient Zbp Forms

1099 Misc Form Copy B Recipient Zbp Forms

What Is A 1099 Misc Form Financial Strategy Center

What Is 1099 Misc Form How To File It Complete Guide

What Is 1099 Misc Form How To File It Complete Guide

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

1099 Misc Instructions And How To File Square

1099 Misc Instructions And How To File Square

1099 Misc Form 5 Part Carbonless Zbp Forms

1099 Misc Form 5 Part Carbonless Zbp Forms

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

1099 Misc And 1099 Nec Deadline Feb 1 2021 Tax Practice Advisor

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

Upcoming 1099 Changes Escape Technology