What Does Account Number Mean On 1099 Nec

Form 1099-NEC is not a replacement for Form 1099-MISC. It was last used in 1982.

What Is The Difference Between A W 2 And 1099 Aps Payroll

What Is The Difference Between A W 2 And 1099 Aps Payroll

Taxpayer identification number ATIN or employer identification number EIN.

What does account number mean on 1099 nec. It is not for the recipient. This number is XXXXX mandatory. If the FATCA filing requirement box is checked the payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement.

Generally you need to issue a Form 1099-NEC if you pay an independent contractor 600 or more during the year and the payment is not reportable on a Form 1099-K. Changes in the reporting of income and the forms box numbers are listed below. 1099-NEC we have revised Form 1099-MISC and rearranged box numbers for reporting certain income.

Its just a minor paperwork change. However the issuer has reported your complete TIN to the IRS. The IRS reintroduced Form 1099-NEC as the new way to report self-employed income.

A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made. What gets reported with the NEC Box. The rules for Form 1099-NEC are the same as they were for Form 1099-MISC with non-employee compensation in Box 7.

If you pay contract workers or suppliers in the US you probably already know you need to collect a Form W-9 from each contractor and supplier and send them and the IRS a copy of a Form 1099-MISC at the end of the year. Form 1099-NEC is used to report nonemployee compensation. No the account number is XXXXX number that is usually assigned by the payroll company or payer for internal tracking purposes it is not the recipients Id.

Is this the Recipients Identification Number. What does NEC stand for. In the context of 1099 tax filing NEC stands for Nonemployee Compensation the first letters of the three words None Employee and Compensation.

When you get your Forms 1099-NEC for your nonemployee compensation youll see that youve received Copy B. This process is now changing a little bit for the 2020 tax year and weve put together some of the must-know information related to those changes. What is the account number on a 1099.

For the tax year 2020 the IRS separate the non-employee compensation into a new form and well have to track the transactions separately by creating a new account for the 1099-NEC too. Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return. An account number is shown below box 10 on Form 1099R and says see instructions.

This was done to help clarify the separate filing deadlines on Form 1099-MISC and the new 1099-NEC form will be used starting with the 2020 tax year. Use Form 1099-NEC to report nonemployee compensation. Current Revision Form 1099-NEC PDF Information about Form 1099-NEC Nonemployee Compensation including recent updates related forms and instructions on how to file.

Gross proceeds to an attorney are reported. The 1099-NEC only needs to be filed if the business has paid you 600 or more for the year. If you are the issuer of the 1099-R then click the IRS link below and view the Account Number instructions on Page 9.

Nonemployee compensation was previously included on the 1099-MISC form. Crop insurance proceeds are reported in box 9. Yes youll need to move them to the newly created 1099-NEC account in your company file.

Payer made direct sales of 5000 or more checkbox in box 7. If you pay contractors or youre self-employed heres what you need to know. The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used.

Form 1099-NEC is only replacing the use of Form 1099-MISC for reporting independent contractor payments. Most tax payers recognize NEC as box 1 on form 1099-NEC or in the past as box 7 on form 1099-MISC. There are two ways to move the payments to the new 1099-NEC account.

Compensation only needs to be reported on Form 1099-NEC if it exceeds 600 for the previous tax year. You may also have a filing requirement. Form 1099-NEC Nonemployee Compensation is a form that solely reports nonemployee compensation.

The See Instructions is for the entity that issued your pension or retirement plan distribution 1099-R form. If you made less than 600 youll still need to report your income on your taxes unless you made under the minimum income to file taxes. And the 1099-NEC is actually not a new form.

How To Read Your 1099 Robinhood

How To Read Your 1099 Robinhood

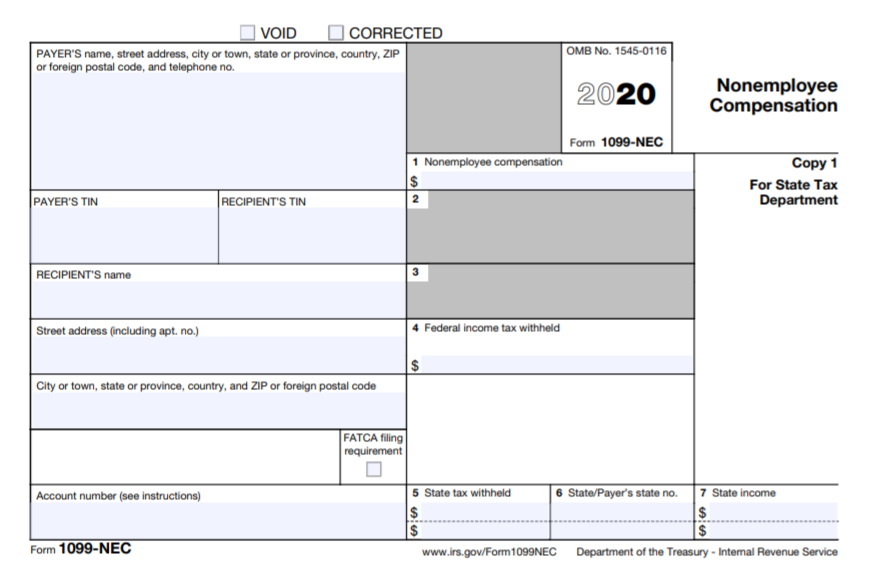

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Tracking Costs Of Handmade Items Got You Frazzled The Yarny Bookkeeper Frazzled Handmade Items Feeling Frustrated

Tracking Costs Of Handmade Items Got You Frazzled The Yarny Bookkeeper Frazzled Handmade Items Feeling Frustrated

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec What Does It Mean For Your Business

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

I Received A Form 1099 Nec What Should I Do Godaddy Blog

I Received A Form 1099 Nec What Should I Do Godaddy Blog

Income Report By Using The Irs 1099 Misc Form 1099 Tax Form Irs Forms Irs

Income Report By Using The Irs 1099 Misc Form 1099 Tax Form Irs Forms Irs

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

4 Ways To Motivate Yourself To Write When You Don T Want To Motivation Tips For Writers How To Motivate Y Bookkeeping Business Writing How To Get Motivated

4 Ways To Motivate Yourself To Write When You Don T Want To Motivation Tips For Writers How To Motivate Y Bookkeeping Business Writing How To Get Motivated

1099 Nec The Dancing Accountant

1099 Nec The Dancing Accountant

Facebook Hacking Messages Language Chinese Language

Facebook Hacking Messages Language Chinese Language

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Which Form Should An Employer Use A W 2 Or A 1099 Nec Business Tax Payroll Taxes What Is Social

Which Form Should An Employer Use A W 2 Or A 1099 Nec Business Tax Payroll Taxes What Is Social

What Is The Account Number On A 1099 Misc Form Workful

What Is The Account Number On A 1099 Misc Form Workful