How To Generate A 1099 In Quickbooks Online

See all your 1099 vendors. Creating a 1099 form for a contractor whom youve added to the employee list is more time-consuming than for a vendor but completing the procedure ensures the contractor has the correct tax status.

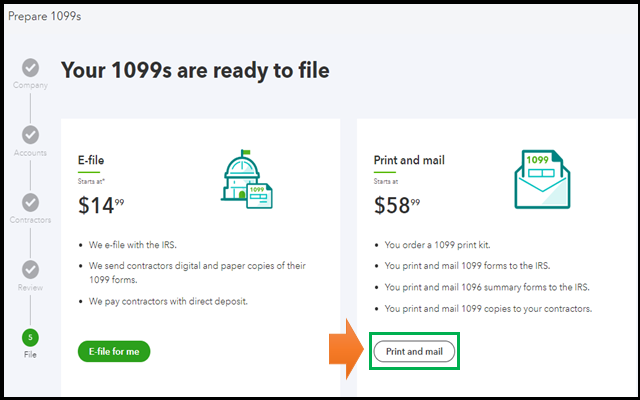

Click on PrintE-File 1099 Forms.

How to generate a 1099 in quickbooks online. Create Custom Invoice Template Quickbooks. QuickBooks Online QBO only reflect the data on 1099 based on the vendor transactions you entered in the program. Ready to create and file 1099s.

Choose the Contractors tab. Go to the Workers menu. This information isnt imported from QuickBooks Online.

To set up a 1099 employee in QuickBooks Online follow the below steps. To generate the 1099 Transaction Details Report you will need to pretend like you want to process your 1099s through QuickBooks Online. Click the Prepare 1099s button.

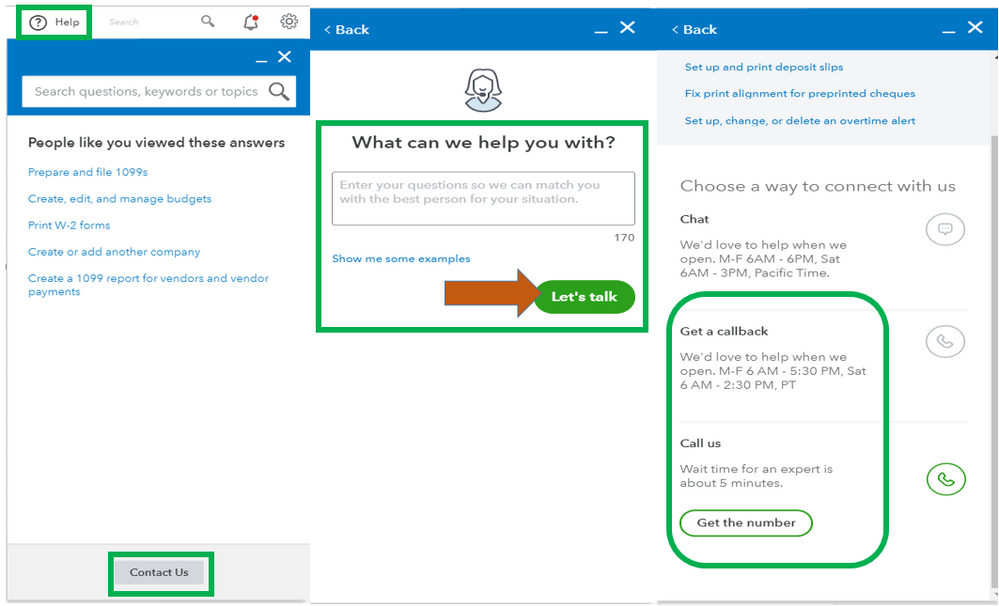

Review your 1099 Forms and make sure that the information brought over from QuickBooks Online is correct. Join Intuit Pro Advisor and QuickBooks Online expert Alicia Katz Pollock as she shows you how to handle 1099s in QuickBooks Online. Also make sure that you have reviewed the 1099 forms before submitting them as we do not handle corrected forms.

Click Finish preparing 1099s. From the Sort by drop-down menu select Track 1099. To change whether you track a vendor for 1099s update the vendor on your vendor list.

See What is a 1099 and do I need to file one. Create Multiple Invoices In Quickbooks Online. With that said it would be best to review first if the information is correct before creating and filing1099 in QBO.

Enter your billing info then select Approve. Click on the Prepare 1099s button. Once there go to the Type of contractors drop-down arrow.

Select vendors who need 1099 and click on Continue. Select Expenses Vendors. Click on the Workers tab then select Contractors.

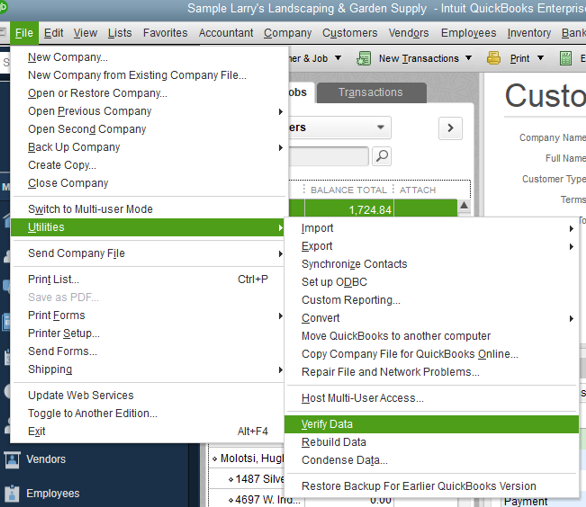

Under RowsColumns select Change columns. See 1099 totals accounts amounts and other details. The procedure to create 1099s in QuickBooks Desktop involves the following steps.

If you want to sort the report by 1099 vendors. Click on Get started and select 1099-NEC or 1099-MISC depending upon the type of your contractors. The first time you run this report you will receive a blank page.

To generate the 1099 Transaction Details Report you will need to pretend like you want to process your 1099s through QuickBooks Online. Click on the Workers tab then select Contractors. The first time you run this report you will receive a blank page.

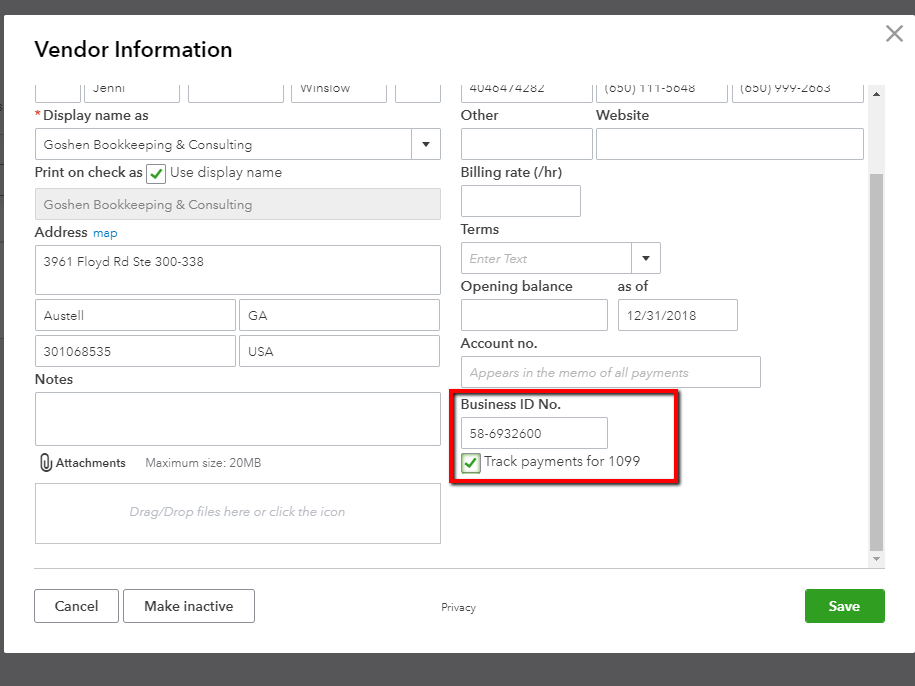

Select anywhere to refresh the report. Select Contractors from the sub-menu and then click Add your first contractor Enter the name and the email of the contractor in the Name and Email. Check Vendor eligible for 1099 Verify the tax.

Create Batch Invoices In Quickbooks Online. Select all or select only the 1099 forms you want to submit. How to Prepare 1099 Tax Forms with QuickBooks Desktop.

Select the Track 1099 checkbox. Click 1099 contractors below the threshold. In this video we will review the 1099 wizard that QuickBooks Online Plus provides for processing 1099 forms for your independent contractorsIf you enjoyed t.

Go to Reports and search for Vendor Contact List. Start QuickBooks and go to Vendors. How To Create 1099 Forms In Quickbooks Online.

To view the detailed data on the form deselect the Alignment box. QuickBooks business accounting software enables you to generate 1099 forms for both categories of independent contractor. Click on the Tax Settings tab and enter the contractors tax identification number or Social Security number if the vendor is a sole proprietor.

Select the Track 1099 checkbox. Go to Step number 4 by clicking Next. Lets go through the process of setting up the 1099 preferences.

Lets go through the process of setting up the 1099 preferences. Select the contractor for whom you want to generate a 1099 then click Print 1099 A preview of the 1099 automatically opens. Select the Sort drop-down menu.

This button is also located in the Vendor. From the main dashboard click the Workers tab on the left-hand side.

How To Prepare And File 1099s In Quickbooks Online

How To Prepare And File 1099s In Quickbooks Online

How To Prepare And File 1099s In Quickbooks Online

How To Prepare And File 1099s In Quickbooks Online

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions

How To Prepare And File 1099s In Quickbooks Online

How To Prepare And File 1099s In Quickbooks Online

Quickbooks Online Prepare 1099 Forms 1099 Misc For Independent Contractors Youtube

Quickbooks Online Prepare 1099 Forms 1099 Misc For Independent Contractors Youtube

Quickbooks Online 1099 Detailed How To Instructions

Quickbooks Online 1099 Detailed How To Instructions