Business Interest Expense Limitation Irs Form

Jul 31 2020 On July 28 2020 the IRS and US. 163 j limit Prop.

Running Your Business From Home Here S How To Get A Tax Deduction Deduction Education Templates Small Business Finance

Running Your Business From Home Here S How To Get A Tax Deduction Deduction Education Templates Small Business Finance

Apr 03 2018 In a Notice and accompanying news release IRS has provided guidance for computing the business interest expense limitation under Code Sec.

Business interest expense limitation irs form. The new guidance takes the form of proposed and final regulations a proposed revenue procedure and a series of frequently asked questions. A pass-through entity allocating excess. Form 8990 The new section 163 j business interest expense deduction and carryover amounts are reported on Form 8990.

1163 j- 1 b 8. If section 163 j applies to you the business interest expense deduction allowed for the tax year is limited to the sum of. The TCJA amended Internal Revenue Code IRC Section 163 j subjecting taxpayers to limitations on the amount of business interest expense they can deduct.

Jun 02 2020 Before the Tax Cuts and Jobs Act TCJA went into effect for tax years beginning after December 31 2017 business interest expense generally was 100 percent deductible. Department of the Treasury Treasury released a series of new rules related to the limitation on deduction for business interest expense under Internal Revenue Code IRC Section 163 j. Or current year or prior year excess business interest expense generally must file Form 8990 unless an exclusion from filing applies.

Current Revision Form 8990 PDF Information about Form 8990 Limitation on Business Interest Expense Under Section 163j including recent updates related forms and instructions on how to file. Use Form 8990 to calculate the amount of business interest expense you can deduct and the amount to carry forward to the next year. However taxpayers cannot claim the additional first-year depreciation deduction for certain types of property held by the electing trade or business.

The business interest limitation does not apply to small taxpayers those with average annual gross receipts of 25000000 or less for the three-year period ending with the prior tax year. Disallowed business interest expense is the amount of business interest expense for a tax year in excess of the amount allowed as a deduction for that tax year under the Sec. Taxpayers are to use Form 8990 Limitation on Business Interest Expense Under Section 163 j to calculate and report their deduction and the amount of disallowed business interest expense to carry forward to the next tax year.

31 2017 business interest expense deductions are limited to the sum of. A disallowed business interest expense carryforward. Limitation on Business Interest Expense Under Section 163j Attach to your tax return.

115-97 12222017 which limits most large businesses interest deduction to any business interest income plus 30 of the business adjusted taxable income. Taxpayers use Form 8990 Limitation on Business Interest Expense Under Section 163j to calculate and report their deduction and the amount of disallowed business interest expense to carry forward to the next tax year. Jun 29 2020 If a partner not subject to the section 163j limitation has excess business interest expense and is allocated excess taxable income or excess business interest income in a subsequent year the partner would file Form 8990 and the amount of excess business interest expense treated as paid or accrued in the current year would not be subject to further limitation under section.

163 j as amended by the Tax Cuts and Jobs Act TCJA. The purpose of this report is to provide text of the regulations and related IRS guidance. Business interest in excess of the limitation can be carried forward indefinitely.

May 2020 Department of the Treasury Internal Revenue Service. Who Must File A taxpayer with business interest expense. The form calculates the section 163 j limitation on business interest expenses in coordination with other limits.

115-97 and amended by the Coronavirus Aid Relief and Economic Security CARES Act PL. Refer to the Form 8990 instructions for more information on the filing requirements and calculations. Form 8990 is to figure the amount of business interest expense you can deduct and the amount to carryforward to the next year.

Disallowed business interest expense later. The business interest expense limitation was enacted in the law known as the Tax Cuts and Jobs Act PL. 163 j for tax years beginning after Dec.

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

Https Www Irs Gov Pub Irs Prior I1120ric 2019 Pdf

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 2106 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Instructions For Form 8990 05 2020 Internal Revenue Service

Instructions For Form 8990 05 2020 Internal Revenue Service

Https Www Irs Gov Pub Irs Utl Tax Forms And Publications Imf Bmf Pdf

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png) Form 1098 Mortgage Interest Statement Definition

Form 1098 Mortgage Interest Statement Definition

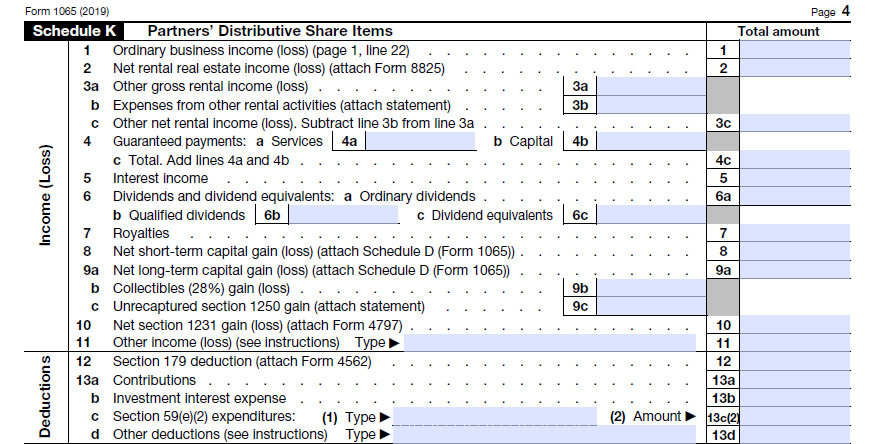

Form 1065 Instructions In 8 Steps Free Checklist

Form 1065 Instructions In 8 Steps Free Checklist

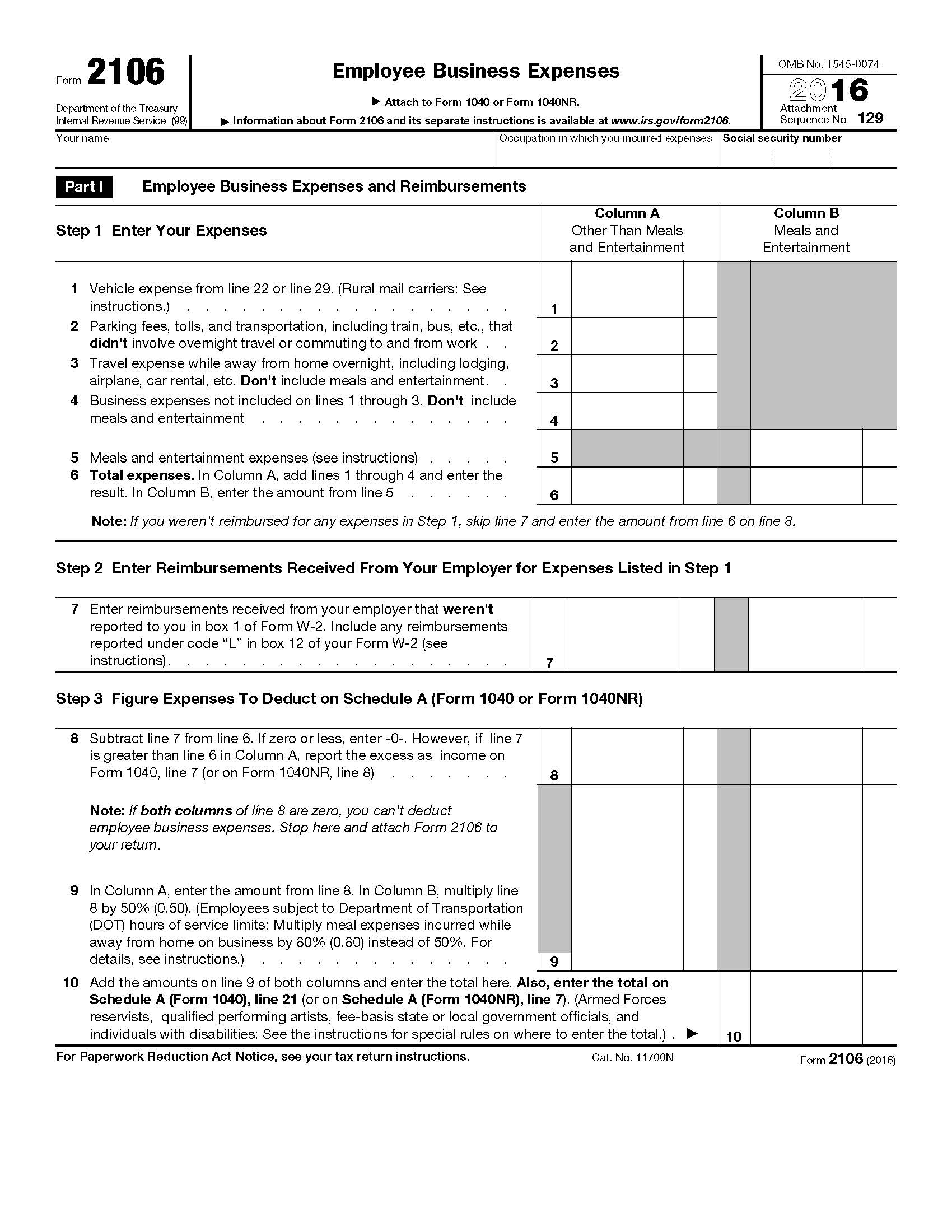

Form 2106 Instructions Information On Irs Form 2106

Form 2106 Instructions Information On Irs Form 2106

Instructions For Form 8995 2020 Internal Revenue Service

Instructions For Form 8995 2020 Internal Revenue Service

Https Www Irs Gov Pub Newsroom Lbi Tcja Participant Guide 163j 13301 Pdf

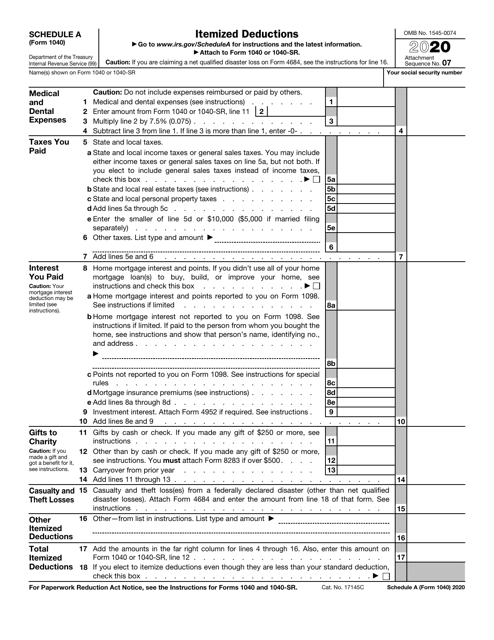

Irs Form 1040 Schedule A Download Fillable Pdf Or Fill Online Itemized Deductions 2020 Templateroller

Irs Form 1040 Schedule A Download Fillable Pdf Or Fill Online Itemized Deductions 2020 Templateroller

What Is Irs Form W 9 Turbotax Tax Tips Videos

What Is Irs Form W 9 Turbotax Tax Tips Videos

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

Irs Form 2106 Employee Business Expenses Wassman Cpa Services Llc

When Is Interest On Debt Tax Deductible

When Is Interest On Debt Tax Deductible