What Companies Use 1099

Who gets a 1099. Think of this form as the equivalent of the W-2 you would receive from an employer if you worked for wages or a salary.

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

1099 Misc Form 1099 Misc Tax Basics Irs Tax Forms Tax Forms Form Example

If youve done any work as a freelancer or independent contractor then you could receive a 1099 form from companies youve worked with most likely a 1099-MISC.

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

What companies use 1099. The difference between a 1099 employee and others is usually easy to recognize. Payments for which a Form 1099-MISC is not required include all of the following. Banks investment companies and other financial institutions are required to provide taxpayers with a 1099-DIV by Jan.

1099-MISC forms report to the IRS exactly how much a company has paid you in the last tax year as a non-employee they are the alternative to W-2 forms which companies and organizations use to declare income for employees. The 1099-NEC reports money received for services provided by independent contractors freelancers and sole proprietors. CPAs Your Landlord.

You are required to send Form 1099-NEC to vendors or sub-contractors during the normal course of business you paid more than 600 and that includes any individual partnership Limited Liability Company LLC Limited Partnership LP or Estate. The IRS considers trade or business to include. The difference between a 1099 income versus W-2 income earner is that a 1099 income earner will be required two years 1099 income history in order to qualify for a mortgage 1099 income versus W-2 income mortgage applicants will need to also provide proof that their 1099 income will likely continue for the next three years.

However see Reportable payments to corporations later. A 1099-NEC form is used to report amounts paid to non-employees independent contractors and other businesses to whom payments are made. You might have a few vendors who you know you need to provide a 1099-MISC to but there might be more that you dont think of.

Its like an employees year-end W-2 with similar data fields but used by businesses that pay non-employee contractors such as freelancers or contract workers. If youre a 1099 worker or a small business that employs 1099 workers seeking a Paycheck Protection Program PPP loan you likely have questions about whether or not you qualify for a PPP loan what you need to apply and how potential loan forgiveness will work. Generally payments to a corporation including a limited liability company LLC that is treated as a C or S corporation.

Weve put together some of the most common questions weve received surrounding PPP and 1099 workers to give you the. One example of an independent contractor is a painter hired to paint your home. A 1099 form is a tax document filed by an organization or individual that paid you during the tax year.

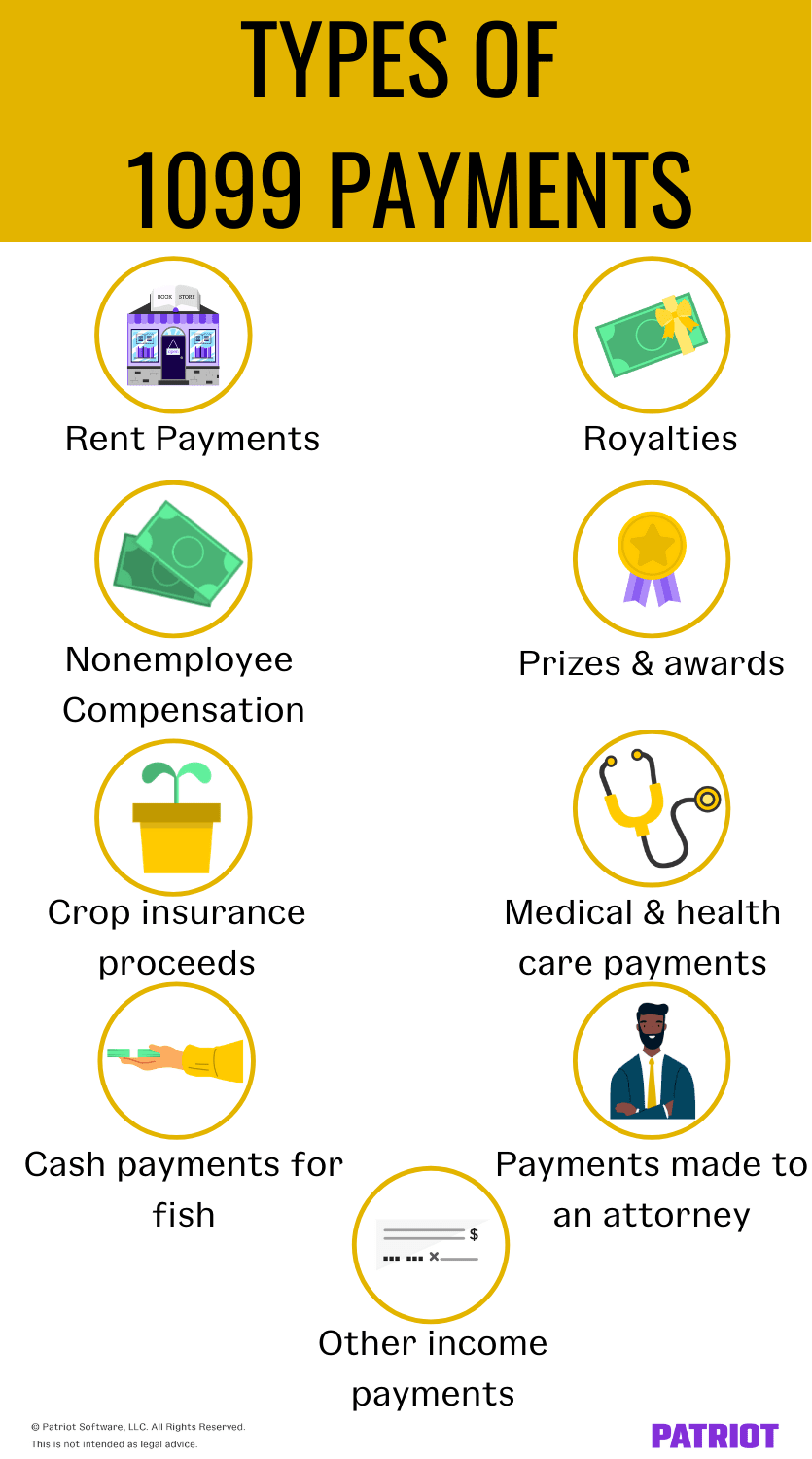

Form 1099-MISC Miscellaneous Income is an information return businesses use to report payments eg rents and royalties and miscellaneous income. The 1099-MISC is an IRS document thats used to report all kinds of income such as that received by an independent contractor for work provided to a business or private employer. In your accounting file look through your vendor list for.

File Form 1099-MISC for each person you have given the following types of payments to during the tax year. You should send a 1099-MISC to every contractorthis means individuals or unincorporated businesses such as LLCsto whom you paid 600 or more for services rent awards or other miscellaneous business-related activities during the year. The majority of small businesses which operate as sole proprietorships partnerships and LLCs require these 1099s if the amounts exceed 600.

Operating for gain or profit. Independent contractors use a 1099 form and employees use a W-2. A non-profit organization including 501 c3 and d organizations.

Companies provide a copy of the Form 1099-DIV to the investor. Payments for merchandise telegrams telephone freight storage and similar items. Contractors are responsible for paying their own payroll taxes and submitting them to the government on a quarterly basis.

Instead of having a permanent worker that takes direction from the company your business would use an independent contractor who works under their own guidance. NEC stands for nonemployee compensation. Non-employees receive a form each year at the same time as employees receive W-2 formsthat is at the end of Januaryso the information can be included in the recipients income tax return.

Independent contractors are 1099 employees. For W-2 employees all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer. This is the equivalent of a W-2 for a person thats not an employee.

If you are in a trade or business you must prepare 1099-MISC forms to show the amounts you have paid to others during the year. At least 10 in royalties or broker payments in lieu of dividends or tax-exempt interest.

1099 Rules For Business Owners In 2021 Mark J Kohler

1099 Rules For Business Owners In 2021 Mark J Kohler

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

Do You Have To Carry Workman S Comp Insurance On 1099 Contractors Workers Compensation Insurance Contractors General Contractor Business

Do You Have To Carry Workman S Comp Insurance On 1099 Contractors Workers Compensation Insurance Contractors General Contractor Business

Do You Understand The 1099 Misc Ageras Irs Tax Forms Irs Taxes Tax Tricks

Do You Understand The 1099 Misc Ageras Irs Tax Forms Irs Taxes Tax Tricks

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

2015 Form 1099 Misc Tax Forms Irs Forms 1099 Tax Form

2015 Form 1099 Misc Tax Forms Irs Forms 1099 Tax Form

1099 Payments How To Report Payments To 1099 Vendors

1099 Payments How To Report Payments To 1099 Vendors

Tax Benefits Of 1099 Vs W2 Tax Work From Home Companies Tax Preparation

Tax Benefits Of 1099 Vs W2 Tax Work From Home Companies Tax Preparation

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable 1099 Misc Tax Basics Irs Forms 1099 Tax Form Tax Forms

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Make Sure You Have A W 9 For Each Recipient In 2020 Irs Forms 1099 Tax Form Tax Forms

Make Sure You Have A W 9 For Each Recipient In 2020 Irs Forms 1099 Tax Form Tax Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

1099 Form Fillable What Is Irs Form 1099 Q Turbotax Tax Tips Videos 1099 Tax Form Tax Forms Irs Forms

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

Form 1099 Misc 2018 Tax Forms Irs Forms State Tax

1099 K What S The Deal With This New Tax Form Small Business Tax Business Tax Tax Forms

1099 K What S The Deal With This New Tax Form Small Business Tax Business Tax Tax Forms

Income Report By Using The Irs 1099 Misc Form 1099 Tax Form Irs Forms Irs

Income Report By Using The Irs 1099 Misc Form 1099 Tax Form Irs Forms Irs

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template