Michigan Business Tax Extension Form

Form 4 is required to be filed to seek for Michigan State Extension only if you do not have Federal state extension. Extension the Michigan Department of Treasury Treasury will grant a 6 month extension for Individual Income Tax IIT and composite returns or a 55 month extension for fiduciary returns.

Free 10 Sample Business Tax Forms In Pdf Ms Word Excel

Free 10 Sample Business Tax Forms In Pdf Ms Word Excel

Developers producing MBT tax preparation software and computer-generated forms must support e-file for all eligible Michigan forms that are included in their software package.

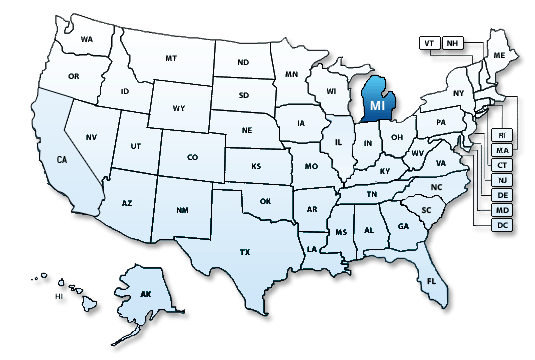

Michigan business tax extension form. If federal extension is accepted the Department will grant an automatic extension to the last day of the 8 th month following the return due date. Arkansas Delaware Illinois Indiana Iowa Kentucky Maine Massachusetts Minnesota Missouri New Hampshire New Jersey New York Oklahoma Vermont Virginia Wisconsin. Monday - Friday 800 am.

Use Form 7004 to request an automatic 6-month extension of time to file certain business income tax information and other returns. Extended Deadline with Michigan Tax Extension. 24 rows Application for Extension of Time to File Michigan Tax Returns.

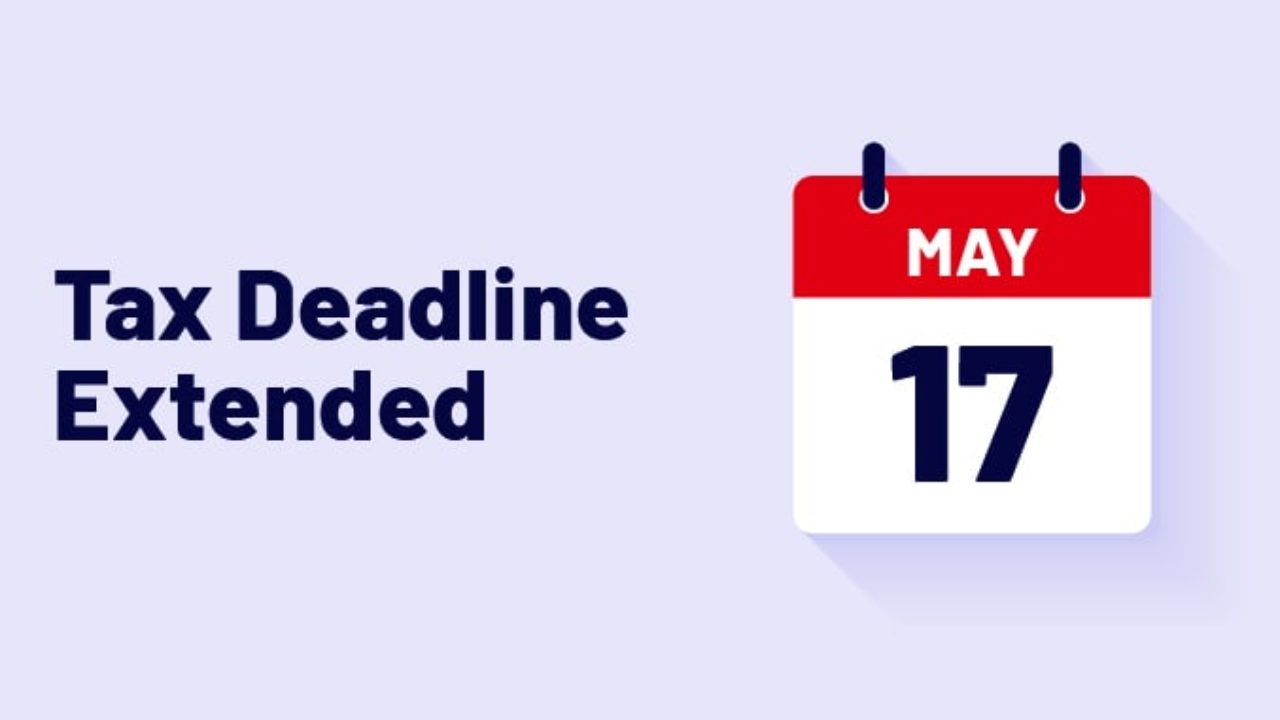

Information on e-filing Form 7004 Information about Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns including recent updates related forms and instructions on how to file. 4889 2021 Request for Accelerated Payment for the Brownfield Redevelopment Credit and the Historic Preservation Credit. Automatic Extension for Individual and Composite State Income Tax Returns Due on April 15 2021 The Michigan Department of Treasury does not administer the federal stimulus program or have any information regarding federal stimulus payments.

A fiscal year taxpayer may request an additional extension on Form 4 Application for Extension of Time to File Michigan Tax Returns if the extension to April 30 2013 is not sufficient eg a taxpayer with a fiscal year ending November 2012 with a federal extension granted through September 2013. To request a Michigan extension file Form 4 by the original deadline of your return. Michigan tax is due send the amount due and a completed Form 4 or a copy of your federal extension form.

Michigan Tax Extension Form. Michigan State General Business Corporation tax extension Form 4 is due within 4 months and 15 days following the end of the corporation reporting period. Michigan General Corporation Tax Extension.

Taxes Site - Business Tax Forms Browsers that can not handle javascript will not be able to access some features of this site. City of Pontiac 47450 Woodward Avenue Pontiac Michigan 48342 2487583000 City Hall Hours. Form 4868 Addresses for Taxpayers and Tax Professionals If you live in.

And you ARE NOT enclosing a payment use this address And you ARE enclosing a payment use this address. Form 5209 for individual city filing extensions or Form 5301 for city interest will accrue on the unpaid tax from the original due date of corporate extensions. Beginning with the 2010 tax year Michigan will have an enforced Michigan Business Tax MBT e-file mandate.

Pay your monthly or quarterly estimated payments at Michigan Treasury Online. A Michigan business extension will give you until the last day of the 8 th month beyond the original deadline of your return August 30 for calendar year filers. 4913 2020 Corporate Income Tax Quarterly Return.

The taxpayer will need to provide the Department with a copy of the federal extension request and pay tax. MBT E-file Mandate for Tax Year 2010. The City of Flint by ordinance collects a local income tax of 1 from residents and 05 for non-residents who work within the CityThe Income Tax Division is responsible for administering the Citys Income Tax.

Extension of time to file can be granted by the Department for with a timely application and payment of tax due. Web-Based Tool for Completing Form 4585. 4913 2021 Corporate Income Tax Quarterly Return and Instructions.

To apply for a Michigan extension file Form 4 Application for Extension of Time to File Michigan Tax. An extension of time to file is not an extension of time to pay. 2020 GR-1120 Corporation Income Tax Return Form PDF 397KB 2020 Schedule RZ of GR-1120 Corporation Renaissance Zone PDF 103KB 2020 GR-7004 Corporate Extension Application PDF 141KB 2019 GR-1120 Corporation Income Tax Return Form PDF 275KB 2019 GR-7004 Corporate Extensionpdf PDF 184KB 2018 GR-1120 Corporation Income Tax Return.

Some functions of this site are disabled for browsers blocking jQuery. Michigan offers a 4-month business extension which moves the filing deadline to the last day of the 8 th month following the original deadline of your return August 30 for calendar year filers. Extension payment with this form.

If you have your federal state extension already done then you need to send the copy of federal extension return to Michigan Treasury. If filing Form 4 do not send a copy of the federal extension to. A business extension must be requested from the Michigan Department of Treasury even if you have a valid Federal tax extension IRS Form 7004.

Services provided by this division include collection of income tax payment plans and enforcement of the Income Tax ordinances. To file an extension for Form 4913 apply for an extension using Form 4 on or before the same date the business tax return is due.

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

2021 Tax Deadline Extension What Is And Isn T Extended Smartasset

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

File Llc Tax Extension Form Online Single Multi Member Llc Extension

File Llc Tax Extension Form Online Single Multi Member Llc Extension

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

E File Irs Form 7004 Business Tax Extension Form 7004 Online

E File Irs Form 7004 Business Tax Extension Form 7004 Online

Https Www Michigan Gov Documents Taxes 5321 Ty2020 684335 7 Pdf

Https Www Michigan Gov Documents Treasury Treasury Update November 2018 639524 7 Pdf

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

Michigan Business Personal Information Nonprofit Tax Extensions

Michigan Business Personal Information Nonprofit Tax Extensions

How To File Michigan 2020 State City Income And Unemployment Taxes

How To File Michigan 2020 State City Income And Unemployment Taxes

![]() Michigan Business Personal Information Nonprofit Tax Extensions

Michigan Business Personal Information Nonprofit Tax Extensions

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

2020 Tax Deadline Extension What You Need To Know Taxact

2020 Tax Deadline Extension What You Need To Know Taxact

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

How To File An Extension For Taxes Form 4868 H R Block

How To File An Extension For Taxes Form 4868 H R Block

Https Www Michigan Gov Documents Taxes Book Mi 1040 With Forms 674611 7 Pdf

Understanding The 1065 Form Scalefactor

Understanding The 1065 Form Scalefactor

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

3 11 212 Applications For Extension Of Time To File Internal Revenue Service

Https Www Michigan Gov Documents Treasury Treasury Update November 2018 639524 7 Pdf