Independent Contractor Mileage Deduction Commuting

For tax year 2020 the amount you can deduct is 575 cents per mile. The mileage tax deduction rules generally allow you to claim 0575 per mile in 2020 if you are self-employed.

Certified Management Accountant Cpa Maryland Bethesda Accountant Mileage Deduction Business Tax Deductions Accounting Training

Certified Management Accountant Cpa Maryland Bethesda Accountant Mileage Deduction Business Tax Deductions Accounting Training

Deduct your mileage Employees are not allowed to deduct the cost of driving to and from home to work.

Independent contractor mileage deduction commuting. But the IRS only lets you deduct business mileage on your taxes. Independent contractors who use a portion of their home for work and no other purpose can deduct either 5 per. Are they always asking for money.

Yes you can deduct mileage because you are an independent contractor and your primary place of business is your home. Since your home is your primary place of business going to and from the worksite would not be considered commuting miles. The IRS will allow you to deduct business miles as an independent contractor.

Do you have teenage kids. Your commute is not tax deductible. If you work from your home all your miles are typically deductible anytime you get in your car and drive for any purpose related to your business.

I was an independent contractor last year. If you are self-employed or an independent contractor these are the rules for mileage deduction and commuting. Your deductible miles depend on where your primary place of business is located.

After youve separated your personal miles from your business miles for the year you can use the standard mileage rate method and deduct 545 cents for every business mile driven as of 2018. The standard mileage rate you can write off changes every year. Freeman to partially deductible subject to the 2 of adjusted gross income limitation.

1 Are Commuting Miles Deductible. For your records document all dates miles traveled and the construction-related purpose of each trip. What is a principal place of business.

You use the standard mileage rate. The time you spend traveling back and forth between your home and your business is considered commuting and the expenses associated with commuting standard mileage or actual expenses are not deductible as a business expense. Home office deduction.

Commuting whether a worker is an independent contractor or an employee is never deductible. Business miles are considered a miscellaneous deduction. You can deduct driving costs from your business location to work-related activities even if its just dropping packages off at the post office.

Beginning with the 2018 tax year through the 2025 tax year employees cant deduct these expenses on Schedule A. But really is there a commuting to work deduction. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons.

However driving between ones principal place of business and a workplace is a deductible travel expense. You may get around this if you have a qualifying home office deduction. If you operate your business from somewhere other than your home you cant deduct the miles you drive to that location theyre considered commuting.

In the past you could deduct any driving expenses that were not paid by your employer on your personal tax return. If FedEx loses all those driverss unreimbursed mileage expenses assuming that is the case will go from fully deductible for independent contractors like Mr. But if you are self-employed and your home is your principal place of business you can deduct the cost of driving from home to see a client or to go to another work location.

However the IRS will not allow a mileage deduction for commuting miles so it is important to understand the difference. You cannot deduct commuting expenses no matter how far your home is from your place of work. You can claim them if your total miscellaneous deductions exceed 2 percent of your adjusted gross income.

A principal place of business is the primary location where the work of that business is performed. No you can only deduct mileage for business charity or medical reasons. See IRS Publication 463.

Deductability Of Self Employed Commuting Expense

Deductability Of Self Employed Commuting Expense

Here S What You Should Do If You Forgot To Track Your Mileage Expressmileage

Here S What You Should Do If You Forgot To Track Your Mileage Expressmileage

Freelancer S Guide To Car Tax Deductions

Freelancer S Guide To Car Tax Deductions

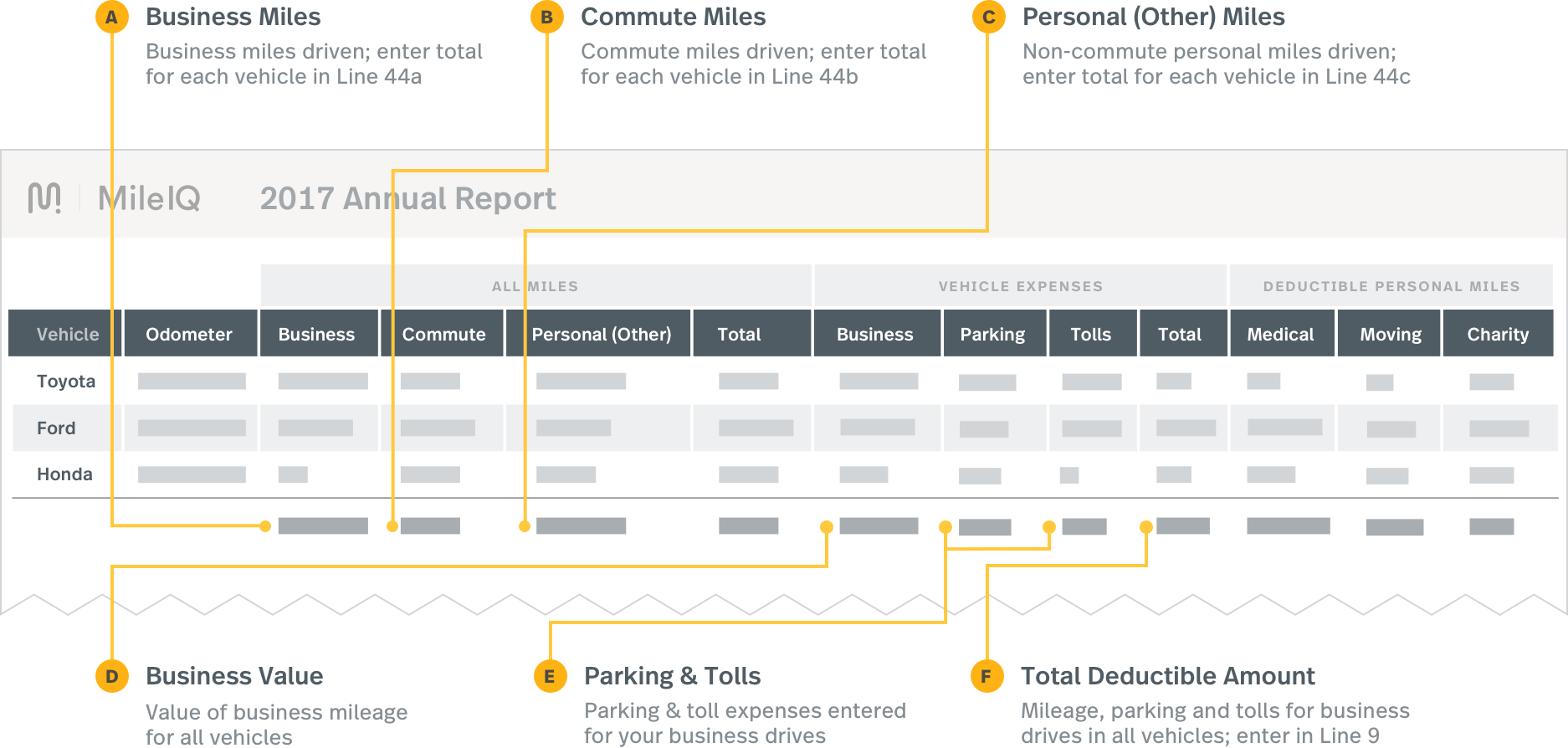

Reporting Mileiq Mileage With Tax Software Mileiq

Reporting Mileiq Mileage With Tax Software Mileiq

What S The Difference Between Business Miles Vs Commuting Miles For Taxes

What S The Difference Between Business Miles Vs Commuting Miles For Taxes

What Can Independent Contractors Deduct

.svg)

Form 2106 Instructions Information On Irs Form 2106

Form 2106 Instructions Information On Irs Form 2106

Home Office Can Be A Great Tax Deduction If Done Right Home Office Expenses Home Office Home

Home Office Can Be A Great Tax Deduction If Done Right Home Office Expenses Home Office Home

Temporary Work Locations Commuting Expenses Tax Deductions

Temporary Work Locations Commuting Expenses Tax Deductions

Is This Deductible Biking Driving And Busing To Work The Turbotax Blog

Is This Deductible Biking Driving And Busing To Work The Turbotax Blog

How To Claim A Mileage Tax Deduction In 2020 Mbo Partners

How To Claim A Mileage Tax Deduction In 2020 Mbo Partners

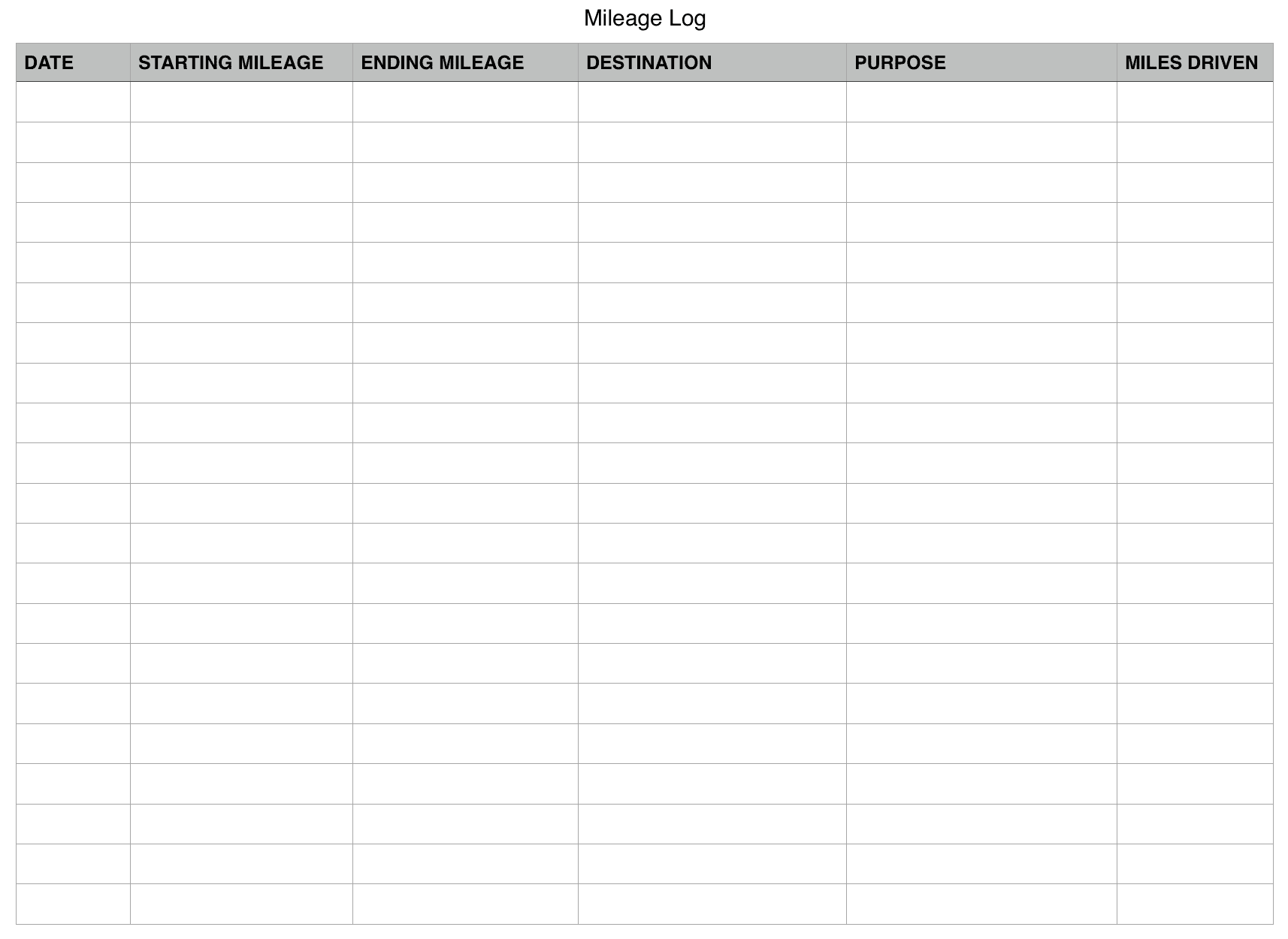

What You Need On Your Mileage Log

What You Need On Your Mileage Log

Three Surprise Car Expenses To Claim On Top Of Miles Entrecourier

Three Surprise Car Expenses To Claim On Top Of Miles Entrecourier

Section 3 Mileage Reimbursement For Self Employed Triplog Mileage

Section 3 Mileage Reimbursement For Self Employed Triplog Mileage

Mileage Tax Deduction How To Write Off Miles For Taxes

Mileage Tax Deduction How To Write Off Miles For Taxes

Business Mileage The Holy Grail Of Tax Deductions

Business Mileage The Holy Grail Of Tax Deductions

Temporary Work Locations Commuting Expenses Tax Deductions

Temporary Work Locations Commuting Expenses Tax Deductions

Tax Q A Business Mileage And Auto Expenses Alignable

Tax Q A Business Mileage And Auto Expenses Alignable