Business Monthly Declaration For Jobkeeper Payment Sole Trader

Make your business monthly declaration between the 1st and 14th day of each month to claim JobKeeper payments for the previous month. Once you have enrolled for the job a payment and identified your eligible employees you or your registered tax or best agent will need to submit a monthly declaration to the ATO to be reimbursed for the job Keeper payments you have made youll need to complete this step even if youre a sole trader and well be able to do this from the first to the fourteenth of each month to receive your reimbursements.

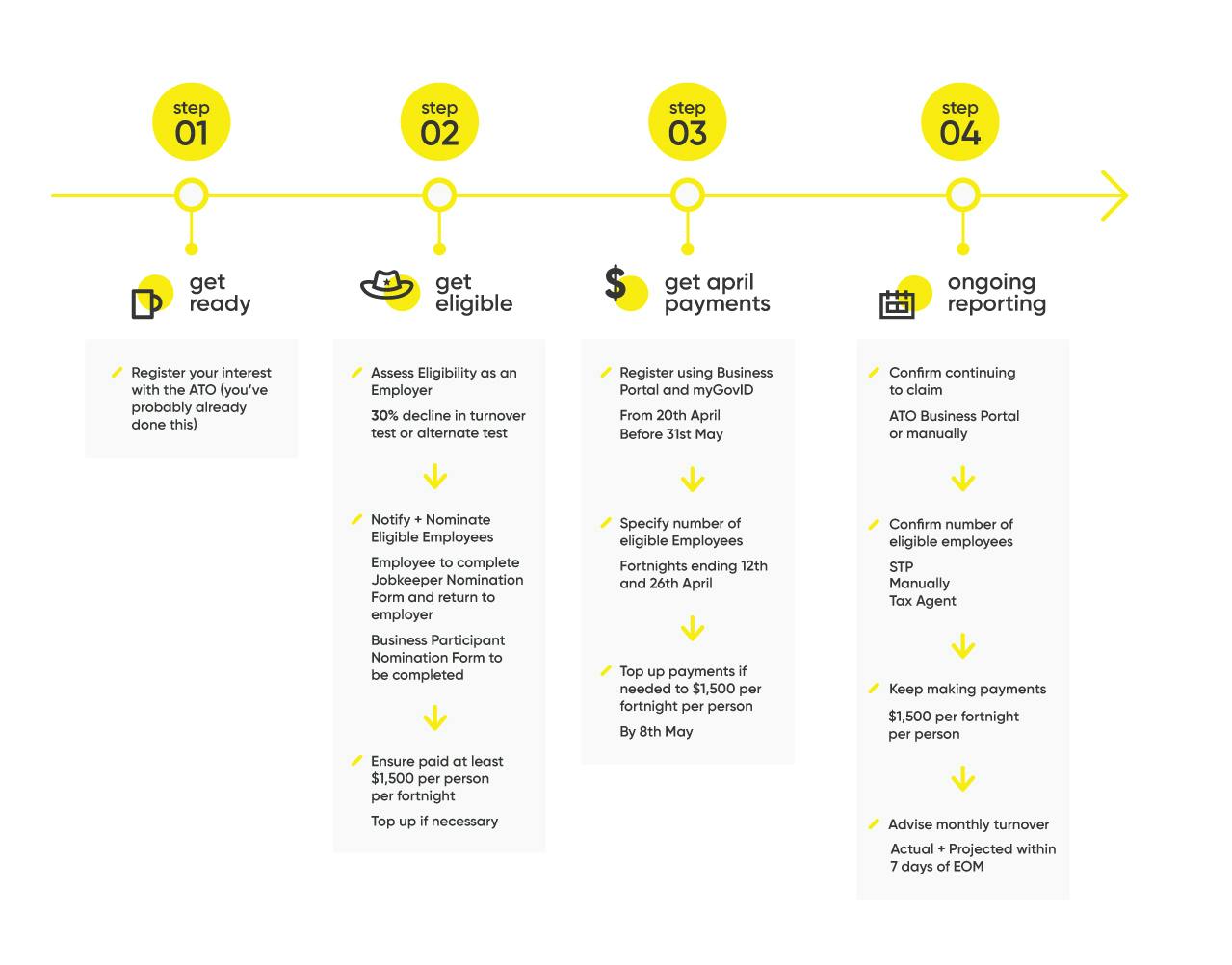

Jobkeeper Payment Important Next Steps

Jobkeeper Payment Important Next Steps

Make a business monthly declaration Key dates From 20 April complete Step 1.

Business monthly declaration for jobkeeper payment sole trader. For example if you qualify for the JobKeeper initiative in April 2020 the business monthly declaration will ask you to declare your GST turnover for April 2020 and the projected GST turnover for May 2020 - see example below. Sole traders without employees can be eligible for a single 1500 payment per fortnight for the eligible business participant. Actual turnover will need to be reported to the ATO through your myGov account by the 7th of each month.

Identify and maintain your eligible employees and eligible sole trader or eligible business participant. Importantly it has been announced that this initiative will also be available to the self-employed ie. Fortnights from 28 September 2020.

Make your declaration by the 14th of each month. Once these fields have been completed you can finalise your. Monthly business declarations for JobKeeper Fortnights in March need to be completed by 14 April 2021 to receive final JobKeeper payments.

Identify and maintain employees and make a monthly business declaration and. They must not be an employee of the entity. This is not a retest of your eligibility for JobKeeper rather an indication of how your business is progressing through the program.

Enrol yourself as a sole trader under the business participation entitlement. Re-confirm your reported eligible employees and business participant if you have them. JobKeeper guide sole traders.

Enrol for the JobKeeper payment Step 2. Notice is hereby given that the Board of Directors declared a second Interim Dividend Number 84 of ZWL 425 cents per share payable out of the profits for the financial year ended 31 March 2021The dividend will be payable on or about 11 May 2021Disbursements to foreign shareholders is subject to Exchange. This person is a non-employee individual who is actively engaged in the operation of the business.

These eligibility requirements apply to ALL sole traders including those who may already be receiving JobKeeper payments before 28 September. Identify and maintain your eligible employees Step 3. In the Business Portal Select Manage employees then the link for the JobKeeper payment.

Work out your eligibility. Enrol for the JobKeeper payment. New criteria which for eligible business participants includes the following.

Late March the Federal Government announced the JobKeeper initiative to help keep more Australians in their jobs. From 4 May complete Step 2. From 28 September 2020 check your actual decline in turnover to receive payments under the extensions to JobKeeper.

The JobKeeper wage subsidy is paid monthly in arrears. For example the September payments should be claimed from us in early October. Fill in the JobKeeper enrolment form by confirming the required fields.

Enrol for the JobKeeper payment. You can create a PDF or print this guide using the buttons at the top-right of your screen. View the COVID-19 screen and select Step 3 Business monthly declaration for JobKeeper payment.

Log into ATO online services via myGov or in the Business Portal External Link using myGovID. All of the following criteria. Jobkeeper Sole Trader Monthly Declaration.

I did not receive any income in the first fortnight of April but then received payments against a backlog of invoices for the second fortnight which now. Through this initiative eligible employers will be able to opt in to receive 1500 per employee per fortnight to help them retain their staff. Please refer to the information contained here for information about the business monthly declaration.

If you are eligible you can claim the JobKeeper payment for yourself as the eligible business participant. For example to be reimbursed for JobKeeper payments paid to your employees in March 2021 you should complete your declaration by. The JobKeeper Payment scheme finished on 28 March 2021.

For JobKeeper fortnights to 27 September 2020 you are entitled to one 1500 JobKeeper payment per fortnight for yourself as the eligible business participant. This has been due to the fact that business has been cancelled and a number of clients have been unable to pay invoices I have submitted to them. You need to have paid your eligible employees at least the relevant JobKeeper amount for each fortnight being claimed.

All sole traders need to satisfy the new eligibility criteria to receive any JobKeeper payments beyond 28 September 2020. Enrol for the JobKeeper payment. This is essentially step three of JobKeeper which is making a monthly declaration.

You only need to complete this step once. You can refer to this JobKeeper guide for sole traders which walks you through the steps of enrolling identifying as an eligible business participant and making a business monthly declaration. Log into ATO online services through myGov or the Business Portal using myGovID.

Managing The Jobkeeper Payment Payroll Support Au

Managing The Jobkeeper Payment Payroll Support Au

Https Www Icb Org Au Out 222721 Ato Webpage Jk Employers Not In Stp 2may20 Pdf

Http Www Absoluteaccountingservices Com Au Static Uploads Files Jk Guide Employers Stp Wfpbnlusfayk Pdf

Check Actual Decline In Turnover Australian Taxation Office

Check Actual Decline In Turnover Australian Taxation Office

Step 3 Make A Business Monthly Declaration Australian Taxation Office

Step 3 Make A Business Monthly Declaration Australian Taxation Office

Our Step By Step Guide To Applying For Jobkeeper Payment Businessdepot

Our Step By Step Guide To Applying For Jobkeeper Payment Businessdepot

Jobkeeper Payment Setup Entirerecruit Help Centre

Jobkeeper Payment Setup Entirerecruit Help Centre

New Jobkeeper Payment Eligibility Of Sole Traders Without Employees Page 22 Uber Drivers Forum

Step 1 Enrol For The Jobkeeper Payment Australian Taxation Office

Step 1 Enrol For The Jobkeeper Payment Australian Taxation Office

How To Complete The Monthly Jobkeeper Report Illumin8 Xero Accountants Mount Eliza Mornington Peninsula

How To Complete The Monthly Jobkeeper Report Illumin8 Xero Accountants Mount Eliza Mornington Peninsula

Http Www Absoluteaccountingservices Com Au Static Uploads Files Jk Guide Employers Stp Wfpbnlusfayk Pdf

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 2 Identify Your Eligible Employees Australian Taxation Office

Jobkeeper For Sole Traders Identifying Yourself As The Eligible Business Participant Airtax Help Centre

Jobkeeper For Sole Traders Identifying Yourself As The Eligible Business Participant Airtax Help Centre

Step 2 Identify Your Eligible Employees Australian Taxation Office

Step 2 Identify Your Eligible Employees Australian Taxation Office

Jobkeeper For Sole Traders How To Make A Business Monthly Declaration Airtax Help Centre

Jobkeeper For Sole Traders How To Make A Business Monthly Declaration Airtax Help Centre