1099-b Instructions 2018

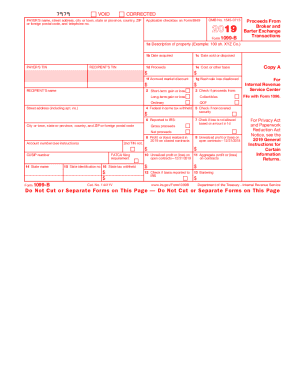

2018 Tax Reporting Statement Instructions 1099-B. Online Ordering for Information Returns and Employer Returns.

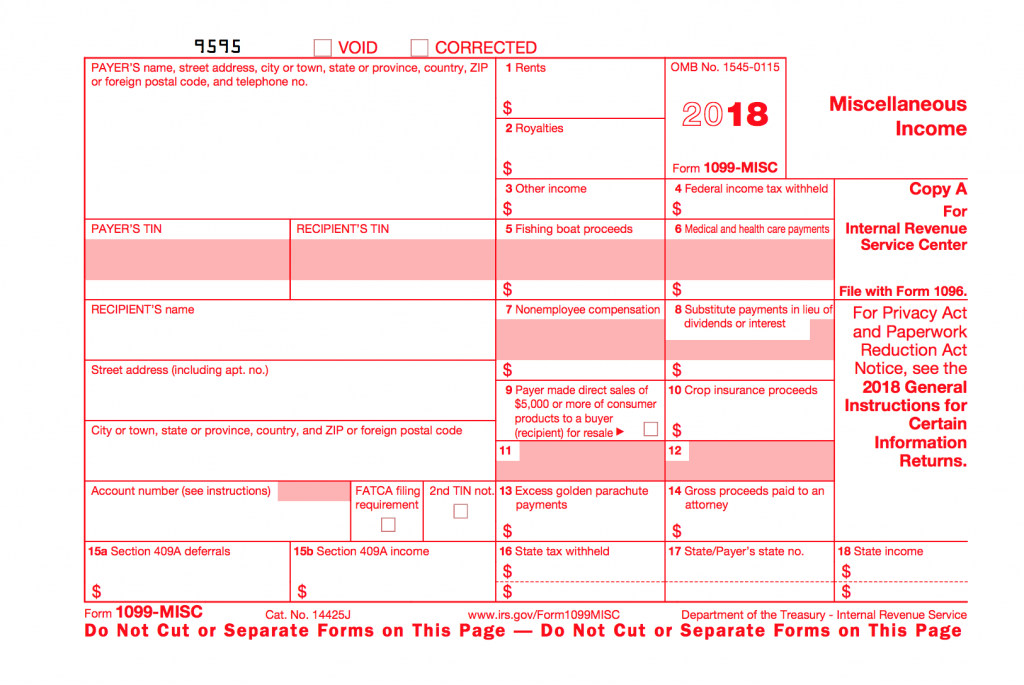

1099 Filing 2018 Deadline Fresh Free Fillable 1099 Misc Form 2018 Da Form 1099 Free Form Design Vincegray2014

1099 Filing 2018 Deadline Fresh Free Fillable 1099 Misc Form 2018 Da Form 1099 Free Form Design Vincegray2014

However if Ordinary is checked in box 2 an adjustment may be required.

1099-b instructions 2018. Adjust the mutual funds cost by adding to it the sales commissions or expenses you paid. About Publication 542 Corporations. 1545-0715 Brokers and barter exchanges must report proceeds from and.

Heres where you enter or import your 1099-B in TurboTax. Other Items You May Find Useful. Instructions for Form 1099-B Proceeds from Broker and Barter Exchange.

If your 1099-B reports the gross sales price you should. Box 4 - Federal income tax withheld Backup withholding is reported here. How to complete any Form Instruction 1099-B online.

The 1099-B should be filed for each person for whom the broker has sold. Save or instantly send your ready documents. If the amounts in 1099-B boxes are negative often listed in parentheses then one MUST include it.

Open continue your return if it isnt already open. On the site with all the document click on Begin immediately along with complete for the editor. You may check box 5 if reporting the noncovered securities on a third Form 1099-B.

Easily fill out PDF blank edit and sign them. Proceeds From Broker and Barter Exchange Transactions Copy A. Enter the amount on the form.

Here is the math. All Form 1099-B Revisions. If you check box 5 you may leave boxes 1b 1e and 2 blank or you may complete.

Correction to the 2017 and 2018 Instructions for Form 1099-B Box 9 Unrealized Profit or Loss on Open Contracts -- 2018-JUN-21. 26 rows Instructions for Forms 1099-A and 1099-C Acquisition or Abandonment of Secured. For whom the broker has sold including short sales stocks commodities regulated futures contracts foreign currency contracts pursuant to a forward contract or regulated futures contract forward contracts debt instruments options securities futures contracts etc for cash.

For mutual fund accounts your Form 1099-B lists your account sales exchanges and redemptions. If you sold shares from your nonretirement Vanguard mutual fund andor brokerage account. Department of the Treasury - Internal Revenue Service.

In TurboTax search for 1099-B and then select the Jump to link in the search results. 1099-B forms must be mailed to recipients by February 16 and e-filed with the IRS by March 31 each year. On the site with all the document click on Begin immediately along with complete for the editor.

For Internal Revenue Service Center. 26 rows Inst 1099-B. 1099-B box11 aggregate PL 1099-B box8 realized PL 1099-B box10 unrealized PL - MINUS 1099-B box9 prior year unrealized PL.

Sometimes the individual sections of the composite forms do not include all of the information that is available on a standard 1099 form such as the check boxes for short-term and long-term transactions on the standard 1099-B form. File with Form 1096. Sale of the noncovered securities on a third Form 1099-B or on the Form 1099-B reporting the sale of the covered securities bought in April 2018 reporting long-term gain or loss.

Complete IRS Instruction 1099-B 2018 online with US Legal Forms. Use your indications to submit established track record areas. Form 1099-B Proceeds from Broker and Barter Exchange Transactions reports the sale of stocks bonds mutual funds and other securities.

Add your own info and speak to data. 2018 General Instructions for Certain Information Returns. Make sure that you enter correct details and numbers throughout suitable areas.

Use your indications to submit established track record areas. Add your own info and speak to data. 2018 Instructions for Form 1099-MISC Miscellaneous Income Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted.

For Privacy Act and Paperwork Reduction Act Notice see the. The 1099-B instructions mention that you may be able to report your transaction s directly on Schedule D if box 3 s checked on the 1099-B and no adjustment is required. PROCEEDS FROM BROKER AND BARTER EXCHANGE TRANSACTIONS OMB NO.

How to fill out the Get And Sign 1099 B 2018-2019 Form online. The advanced tools of the editor will lead you through the editable PDF template. For brokerage accounts your Form 1099-B lists your sales mergers bond maturities and aggregate profits as well as losses on regulated futures contracts.

How to complete any Form Instruction 1099-B online. Future Developments For the latest information about developments related to Form 1099-MISC and its instructions such as legislation. To get started on the document utilize the Fill Sign Online button or tick the preview image of the blank.

A broker or barter exchange must file Form 1099-B for each person. Enter your official contact and identification details.

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

2018 Forms 1099 Misc Due January 31 2019 Miami Cpa Bay Pllc

Internal Revenue Bulletin 2018 39 Internal Revenue Service

Internal Revenue Bulletin 2018 39 Internal Revenue Service

Internal Revenue Bulletin 2018 39 Internal Revenue Service

Internal Revenue Bulletin 2018 39 Internal Revenue Service

Internal Revenue Bulletin 2018 39 Internal Revenue Service

Internal Revenue Bulletin 2018 39 Internal Revenue Service

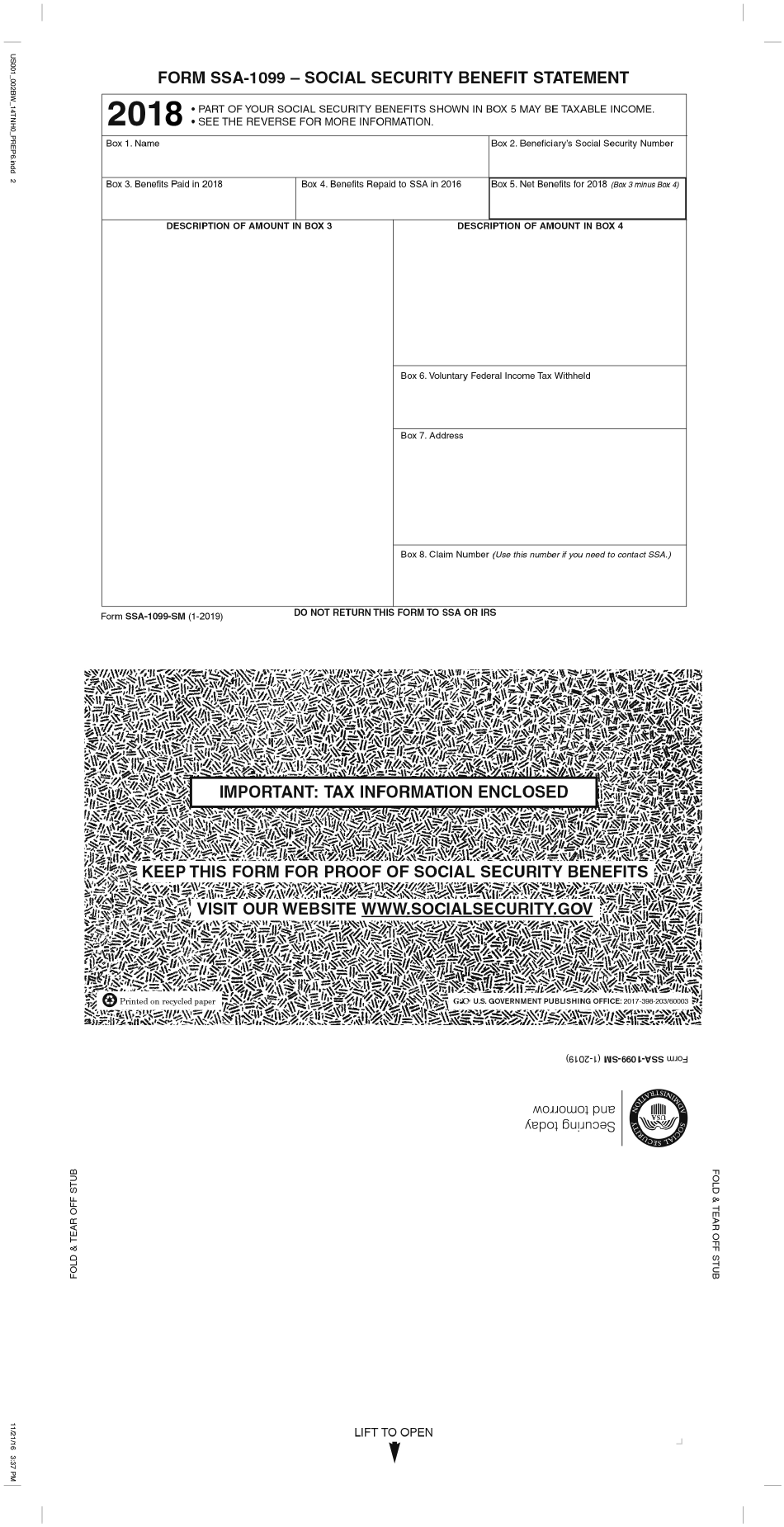

Form Ssa 1099 Download Printable Pdf Or Fill Online Social Security Benefit Statement 2018 Templateroller

Form Ssa 1099 Download Printable Pdf Or Fill Online Social Security Benefit Statement 2018 Templateroller

1099 B 2018 Public Documents 1099 Pro Wiki

Https Www Irs Gov Pub Irs Prior I1099ptr 2018 Pdf

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Internal Revenue Bulletin 2018 39 Internal Revenue Service

Internal Revenue Bulletin 2018 39 Internal Revenue Service

Https Www Irs Gov Pub Irs Prior I1099g 2018 Pdf

2018 Forms 5498 1099 R Come With A Few New Requirements Ascensus

Https Www Fidelity Com Bin Public 060 Www Fidelity Com Documents Taxes 2018 Irs 1099 Instructions Brokerage Pdf

Internal Revenue Bulletin 2018 39 Internal Revenue Service

Internal Revenue Bulletin 2018 39 Internal Revenue Service

Form 8949 Instructions Information On Capital Gains Losses Form

Form 8949 Instructions Information On Capital Gains Losses Form

Michigan 1099 Form 2018 Vincegray2014

Michigan 1099 Form 2018 Vincegray2014

Understanding Your 2018 1099 R Kcpsrs

Understanding Your 2018 1099 R Kcpsrs